In

a report released on February 2, Hana Securities suggested that the domestic

art auction market, led by Seoul Auction, may be entering a rebound phase. The

report, authored by analyst Park Chansol, noted that uncertainties surrounding

transactions have partially eased following the passage of the tax revision

bill. Amid continued increases in real estate and equity prices, artworks may

once again emerge as a store of value.

Seoul Auction Stock Price Overview / Source: Investing.com

K Auction Stock Price Overview / Source: Investing.com

The

core of the report lies not merely in evaluating a single stock, but in

assessing whether the market structure has passed its bottom. Hana Securities

stated that if Seoul Auction and K Auction each expand their consignment

volumes to over KRW 10 billion (approximately USD equivalent) per auction

season, this could be interpreted as a clear signal of a full-scale market

rebound.

"2024 Art Market Survey" Report (Based on 2023 Data) / Photo : Korea Arts Management Service (KAMS)

Preconditions

for Rebound: Tax Environment and Asset Prices

The

tax revision bill passed at the end of 2025 is cited as a factor that has

partially alleviated the wait-and-see attitude among high-net-worth

individuals. The art market, by its nature, is highly sensitive to tax and

policy signals.

At

the same time, as prices of major asset classes such as real estate and

equities continue to rise, the possibility of portfolio diversification into

artworks is being raised. The market boom of 2021 similarly coincided with a

broader asset price upcycle.

From

an investment perspective, this suggests that artworks may once again be

re-evaluated not merely as consumer goods but as alternative assets. However,

as an alternative asset class, artworks are characterized by low liquidity and

limited price discovery. While returns may expand in bull markets, transactions

can stall during downturns. Any investment approach must take these structural

characteristics into account.

(Left) Seoul Auction headquarters, (Right) K Auction headquarters

Real

Indicators: Consignment Volume and Total Sales

In

the auction market, the most reliable leading indicators are total

consignment volume and clearance rates. Hana Securities noted that if

individual auction houses increase consignment volumes to over KRW 10 billion

during the April–June auction season, this would constitute a genuine recovery

signal. This benchmark reflects whether market sentiment is translating into

actual lot composition.

Seoul

Auction currently holds the largest market share in the domestic auction

sector. Together with K Auction, the two companies account for approximately

90% of the Korean art auction market, forming an effective duopoly. Their

consignment strategies and auction results effectively determine the direction

of the domestic market.

From

a collector’s standpoint, this period is particularly significant. The early

phase of expanding consignment volumes often corresponds to a

transitional stage just before prices begin to rise in earnest.

Conversely, once blue-chip works become overheated, entry costs escalate

sharply. Therefore, first-half auction results serve as a critical indicator

for assessing acquisition timing.

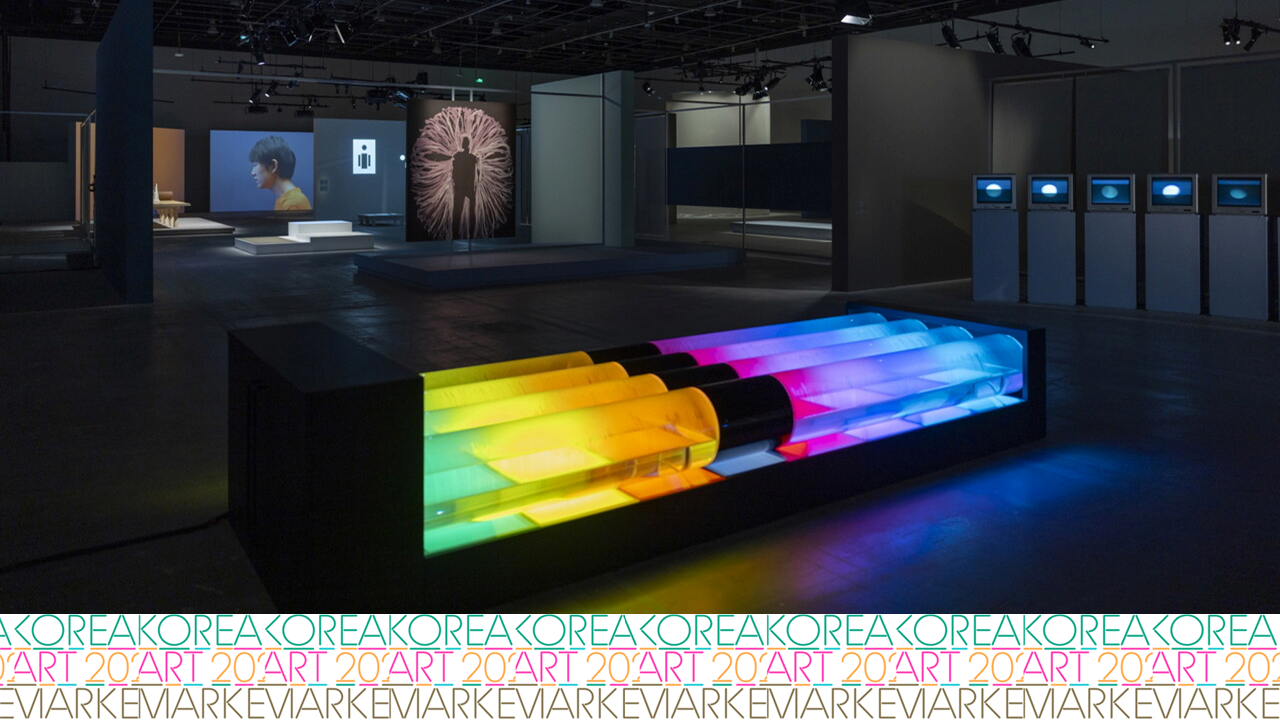

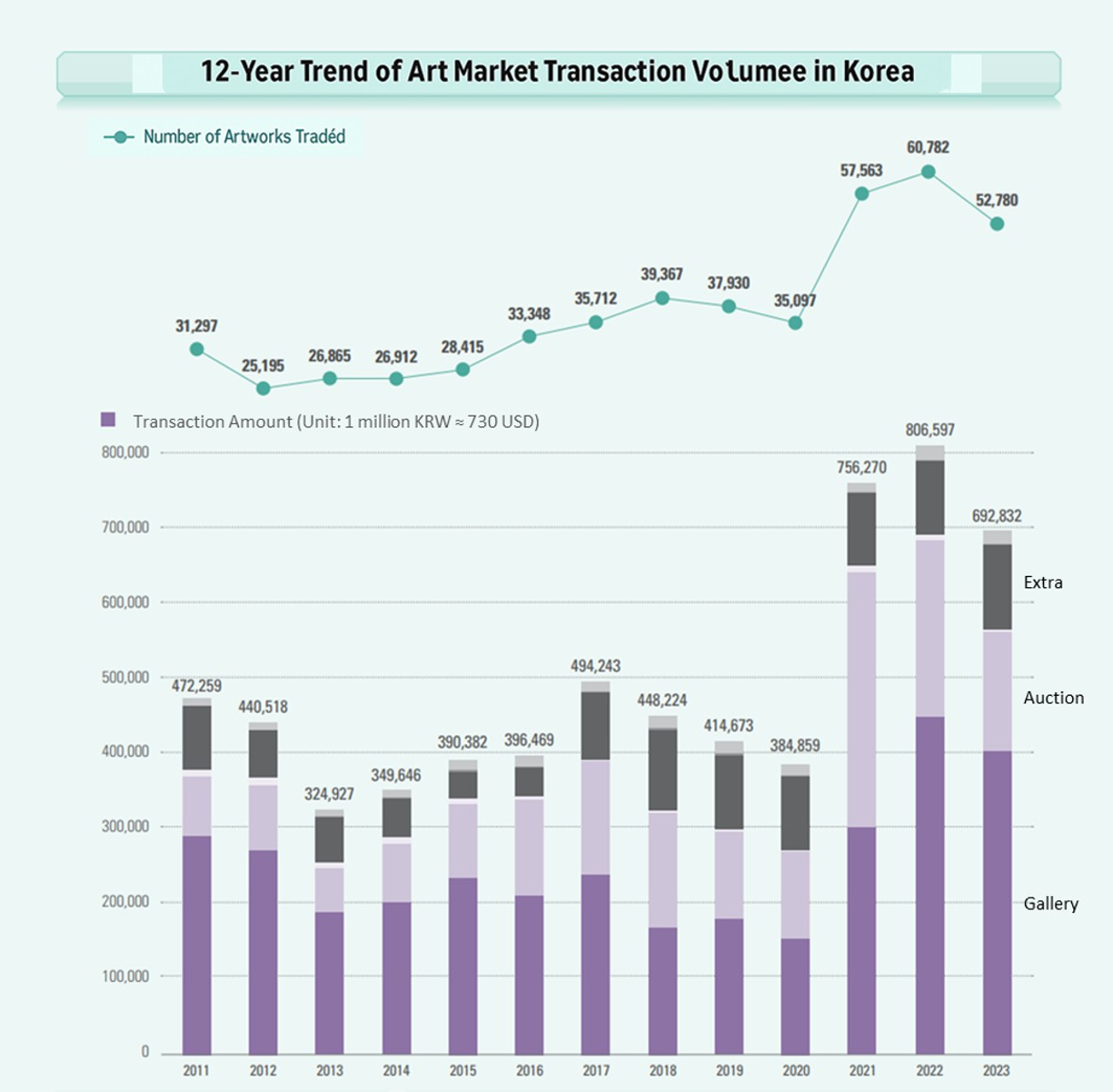

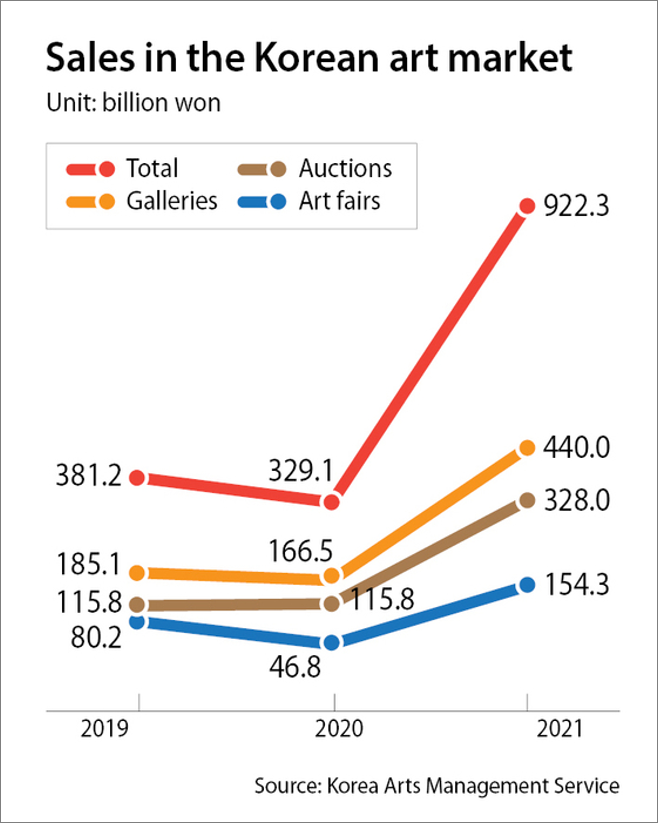

2021 Art Market Statistics / Source: Korea Arts Management Service (KAMS)

Valuation

Perspective: Remembering 2021

The

report references the 2021 boom period as a key comparison point. At that time,

Seoul Auction recorded KRW 79 billion in revenue and KRW 19.7 billion in

operating profit, reaching a market capitalization of approximately KRW 700

billion.

Given

that the company’s business structure has not undergone significant changes,

Hana Securities believes that similar valuation multiples could be applied if

demand rebounds. In other words, an expansion in total auction sales could

directly lead to a revaluation of corporate value.

For

investors, the key variable is the direction of total auction sales. In the

short term, quarterly hammer totals and increases in consignment volumes serve

as leading indicators for corporate performance and share prices. If total

auction sales begin to show double-digit year-on-year growth, this could

justify a reassessment of valuation multiples.

The

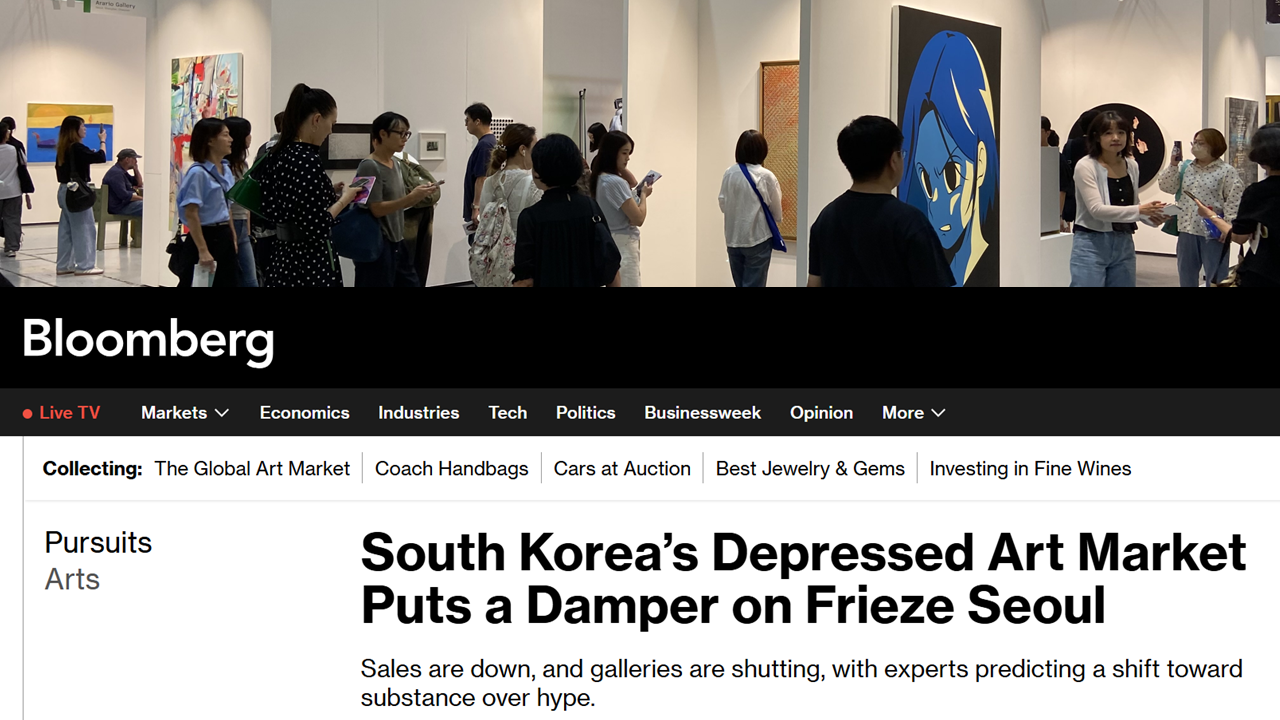

Mid-Low Price Segment and the Art Fair Variable

The

report interprets the recent increase in art fair attendance as a signal of

recovery in the mid- to lower-priced segment. This segment is closely tied to

the inflow of new collectors.

From

a collector’s perspective, as the mid-market stabilizes, the market base

broadens and excessive price concentration on certain blue-chip artists may

ease. In the long term, this can reduce price volatility and strengthen overall

market resilience. From an investment standpoint, expansion in mid-priced

transactions provides a more stable revenue foundation. While high-value works

tend to be volatile, mid-tier transactions offer greater repetition and

turnover.

Risk

Factors and Strategic Implications

The

rebound thesis hinges on three conditions.

First,

whether actual consignment volumes meaningfully expand during the first half of

the year. Second, whether clearance rates remain consistently above 70%. Third, whether total hammer prices for high-value blue-chip works show

meaningful quarter-on-quarter growth.

Investors

should focus less on short-term headlines and more on the trajectory of

consecutive quarterly data. Collectors, meanwhile, should avoid overheated

short-term cycles and selectively approach the market during the early phase of

recovery following price corrections.

Conclusion:

At the Threshold of Structural Recovery

Hana

Securities concluded that Seoul Auction’s auction-related performance has

likely passed its bottom, and that the company’s stock price may soon enter an

upward trend. However, the auction results of the first half of 2026 will

represent more than corporate earnings. They may serve as a turning point in

assessing the structural direction of the entire Korean contemporary art

market.

The

consignment strategies of Seoul Auction and K Auction, the strength of

blue-chip artist results, the resilience of the mid-market, and the broader

asset price environment must align simultaneously. Only then can the current

rebound signal evolve from a temporary recovery into a structural shift. For

investors, this is a moment that calls for data-driven and gradual

positioning. For collectors, it demands selective

acquisition strategies and a long-term perspective.