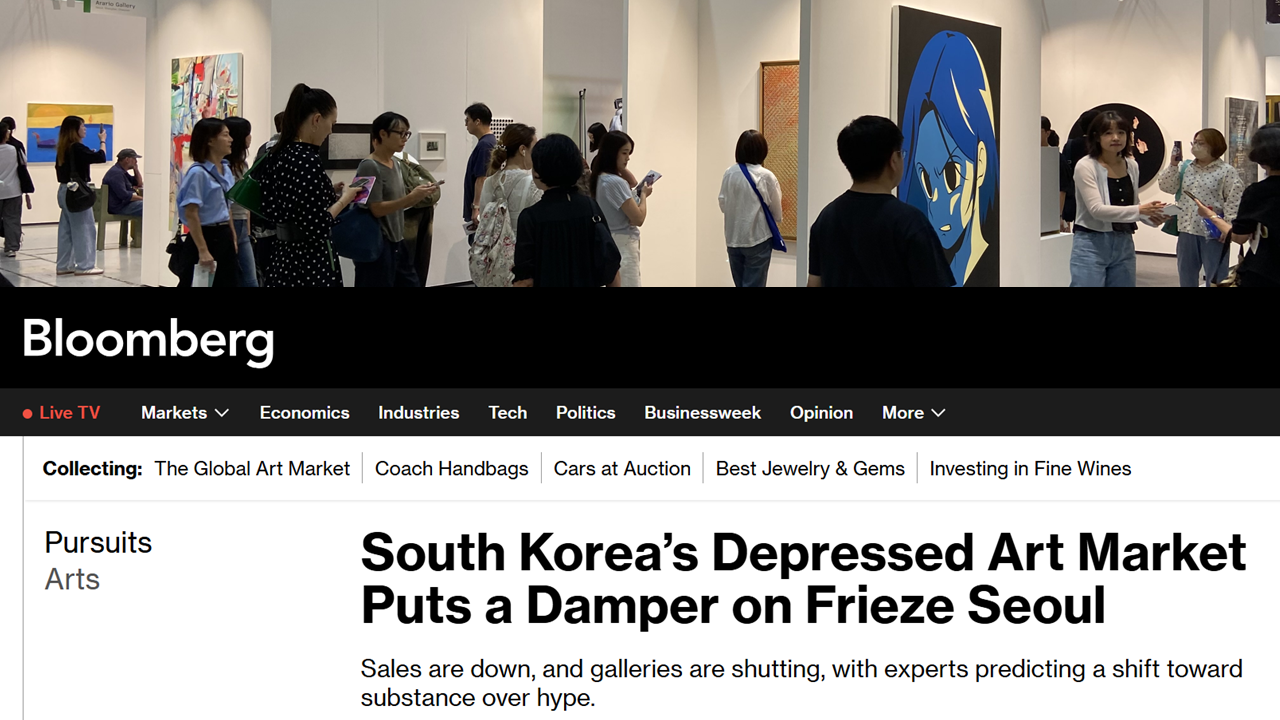

Bloomberg’s

September 4 article “South Korea’s Depressed Art Market Puts a Damper on

Frieze Seoul” offered a global perspective on Korea’s art market.

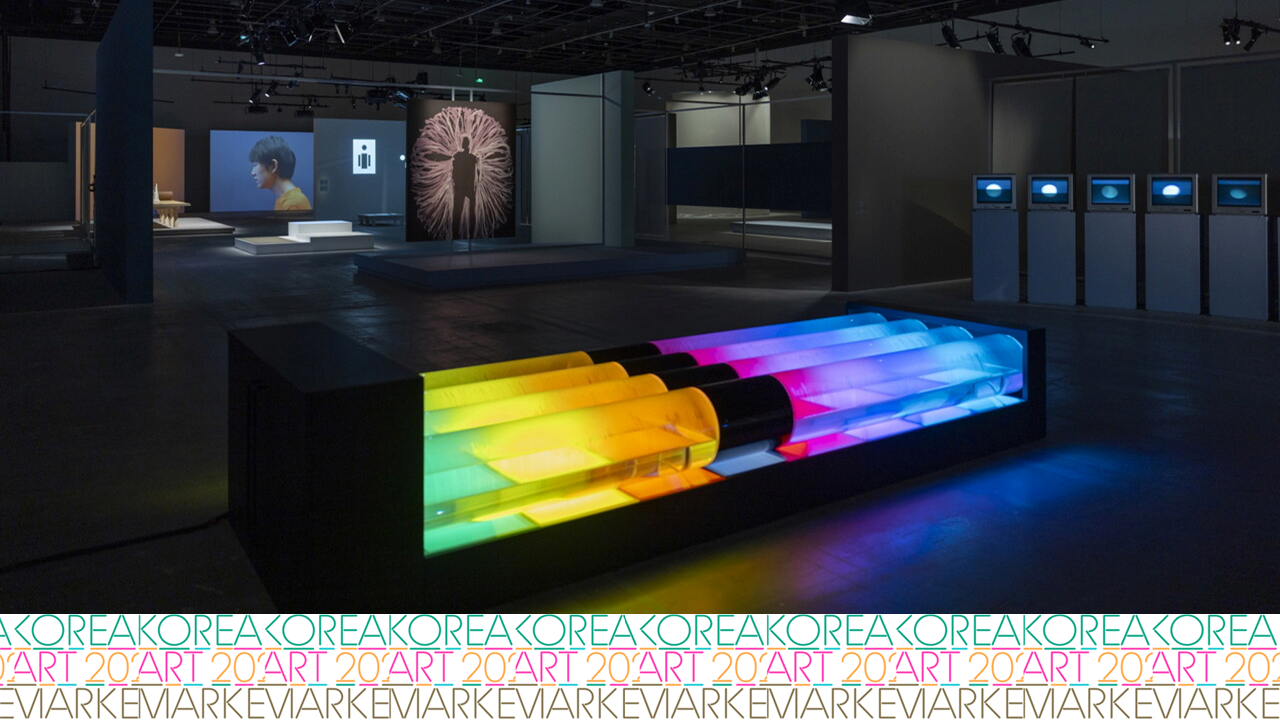

At the 2025 Frieze Seoul, Arario Gallery

The piece goes

beyond a simple account of an economic slowdown. It points to the first major

structural test Korea has faced only a few years after emerging as Asia’s new

hub. The article carries significant implications for how the Korean art world

should interpret the present situation and prepare for the future.

Current

Status: Declining Sales and Auction Indicators

According to

Bloomberg, Seoul quickly rose to become one of the fastest-growing art markets

with the launch of Frieze Seoul in 2022, but has since contracted sharply.

The Korean art

market, which peaked in 2022, has shrunk to around USD 370 million (≈ 500 billion KRW). The number of small galleries has fallen from 700

to 560, and some are now considering closure or withdrawal.

Lee Ufan, Dialogue(2019). In the first half of this year, it was the only work in Korea’s auction houses to sell for over 1 billion won. Despite being a large-scale 300-ho painting, it hammered at 1.6 billion won, below its estimate of 1.9–2.5 billion won. / Photo: Seoul Auction

Kim Whanki, 3-V-71 #203 (1971). In March 2024, it fetched 5 billion won at Seoul Auction’s Contemporary Sale. / Photo: Seoul Auction

Domestic

statistics confirm the downturn. In the first half of 2025, total auction sales

in Korea amounted to about USD 42 million (≈ 57.2 billion KRW), a 37% drop year-on-year. The sales rate was only

48.8%, the lowest in five years, and the highest price achieved was Lee Ufan’s Dialogue

at about USD 11.3 million (≈ 1.6 billion

KRW). Just a year earlier, in March 2024, a Kim Whanki painting sold for about

USD 35 million (≈ 5 billion KRW)

at Seoul Auction—an unmistakable contrast in market sentiment.

Frieze Seoul

and the ‘Shadow of Celebration’

Bloomberg noted

that this trend has cast a “shadow” even over mega international fairs like

Frieze Seoul.

Mark

Bradford’s Okay, then I apologize was sold during

Frieze Seoul 2025 VIP Day by Hauser & Wirth for USD 4.5 million (about 6.3

billion won) to a private Asian collector.

Mark

Bradford’s Okay, then I apologize was sold during

Frieze Seoul 2025 VIP Day by Hauser & Wirth for USD 4.5 million (about 6.3

billion won) to a private Asian collector.

On the surface,

VIP openings and the glamorous arrival of global galleries continue. Yet in

reality, the scale of transactions and collectors’ attitudes have grown

markedly more cautious.

In other words, beneath the festive atmosphere lies a

paradox of subdued trading. This reflects not merely an economic downturn but

also a broader shift in art consumption—from art as a pure luxury good to art

as an “experience good.”

This Weekend Room at Frieze Seoul 2025. The painting by Choi Ji-won (foreground) drew significant attention and sold during the fair. / Photo: This Weekend Room, Instagram

Shifting

Demand Structure: New Purchase Standards

This

transformation is echoed in voices from the field. Young-joo Lee, Vice

President of Pace Gallery Seoul, told Bloomberg:

Young-joo Lee, Vice President of Pace Gallery Seoul / Photo: Luxury Magazine

“Transactions are

slowing down, and collectors no longer buy simply on the belief that ‘art

equals asset.’ They scrutinize a work’s narrative, the artist’s identity, and

curatorial context much more carefully. Exhibitions and art fairs remain

important, but the criteria for purchase have become far stricter.”

Her remarks

illustrate how collectors’ motivations are moving away from purely financial

factors toward qualitative and discursive values. Beyond commercial

worth, the cultural and social narratives embedded in a work are becoming

central to closing sales.

Structural

Pressures: Economy and Institutions

Global inflation,

rising interest rates, and a weakened Korean won continue to weigh heavily on

the market. Dollar-denominated artwork prices and shipping and insurance costs

have added to galleries’ operational burdens.

Domestically,

structural shortcomings such as limited protection of artists’ rights,

inadequate tax incentives, and the absence of reliable authentication

infrastructure further exacerbate instability.

These were not

directly addressed in Bloomberg’s article, but have been repeatedly highlighted

in Korean reports as persistent vulnerabilities in the local market.

The Korean Art

Market at a Crossroads of Crisis and Opportunity

Bloomberg’s

analysis shows that Korea’s contemporary art market is not merely in recession

but at a turning point toward a new order. The decline in auction indicators

and shrinking demand for high-value works are undeniable. Yet, at the same

time, the heightened discernment of collectors and the rising importance of

narrative and identity signal fresh opportunities.

To navigate this

transition successfully, the Korean art market must:

1. Undertake

institutional reforms: protect artists’ rights,

expand tax incentives, and build credible authentication systems.

2. Diversify

its demand base: move beyond reliance on

high-net-worth collectors and engage younger generations and a broader price

spectrum.

3. Produce

international discourse: go beyond the rhetoric of

being an “Asian hub” and develop the capacity to translate Korean contemporary

art into the language of the global art world.

Conclusion

Today, Korea’s

art market stands at the crossroads of crisis and opportunity.

The opportunity lies in the growing sophistication of collectors, whose

acquisitions are shifting from trend-driven purchases to internationally and

intellectually informed collections. Moreover, Frieze Seoul has brought global

attention closer to Korean art than ever before, expanding the possibilities

for international entry and growth.

Bloomberg’s

analysis thus implies that the fate of Seoul—whether it secures a sustainable

position as Asia’s art hub or fades as a short-lived bubble—will be

determined by how the Korean art world responds at this moment of transition.

This is not the

time to rely on short-term sales or surface-level market momentum. Instead, it

is a strategic moment to produce global discourse and establish

institutional foundations that can ensure sustainable international growth.