The January 2026

regular auctions held by Seoul Auction and K Auction served as the first major

test of whether the Korean art market, after a period of adjustment, has begun

to re-enter an active trading phase. The two auctions were held one day apart, and

both their curatorial strategies and results indicate a clear emphasis on

testing market absorption rather than pursuing aggressive expansion.

Rather than

functioning as event-driven auctions aimed at record-breaking prices or

dramatic spikes, these sales were characterized by an effort to assess

realistic transaction potential following the cumulative market corrections of

the past one to two years. The outcomes—reflected in both sell-through rates

and total sales—suggest a moderate recovery signal, indicating that the market

has moved beyond a phase of extreme contraction.

Having gone

through an adjustment phase in 2025, the Korean art market used the January

2026 auctions to once again take the temperature of actual trading activity.

Seoul Auction and K Auction opened the year with their first sales held just a

day apart, and both recorded sell-through rates above 70 percent along with

meaningful total sales, demonstrating that the market remains operational at

the start of the year.

Seoul Auction:

Diversified Structure and the Role of the Mid-Price Segment

Seoul Auction

held its 189th sale on January 27 at its Gangnam Center. A total of 117 lots

were offered, of which 82 were sold, resulting in a sell-through rate of 72.6

percent. Total hammer sales amounted to approximately KRW 4.1454 billion (about

USD 2.86 million).

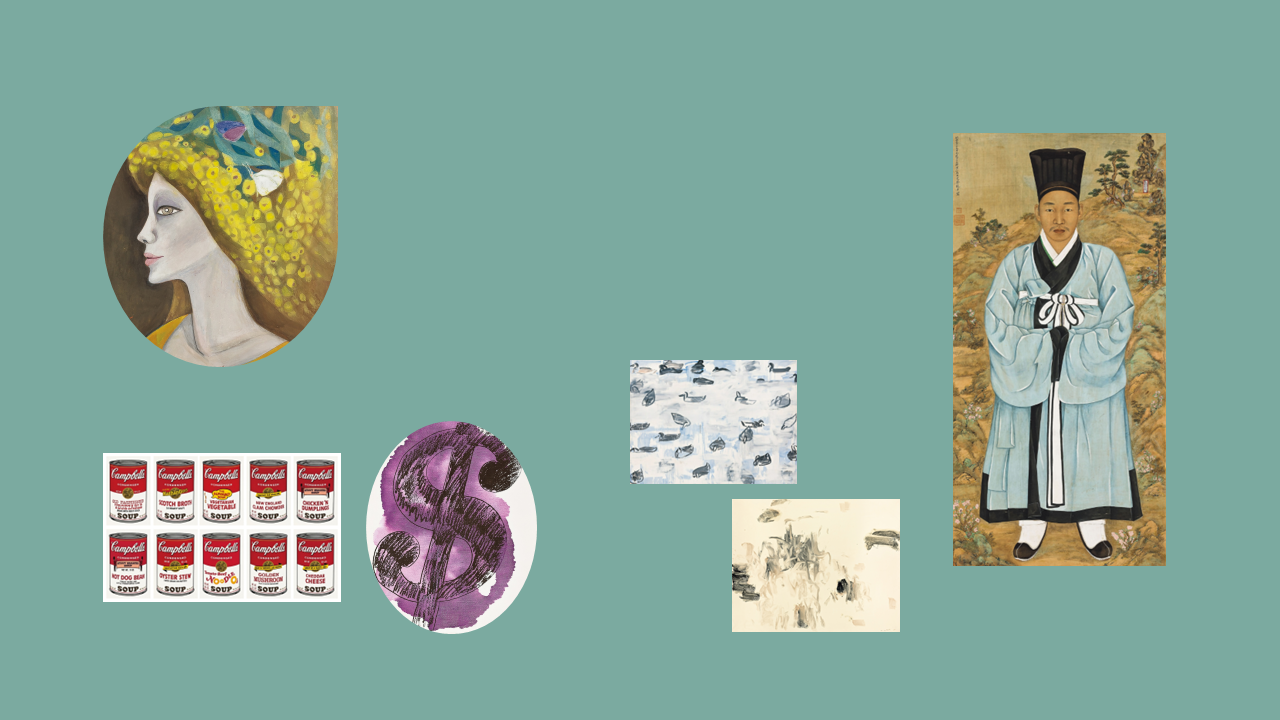

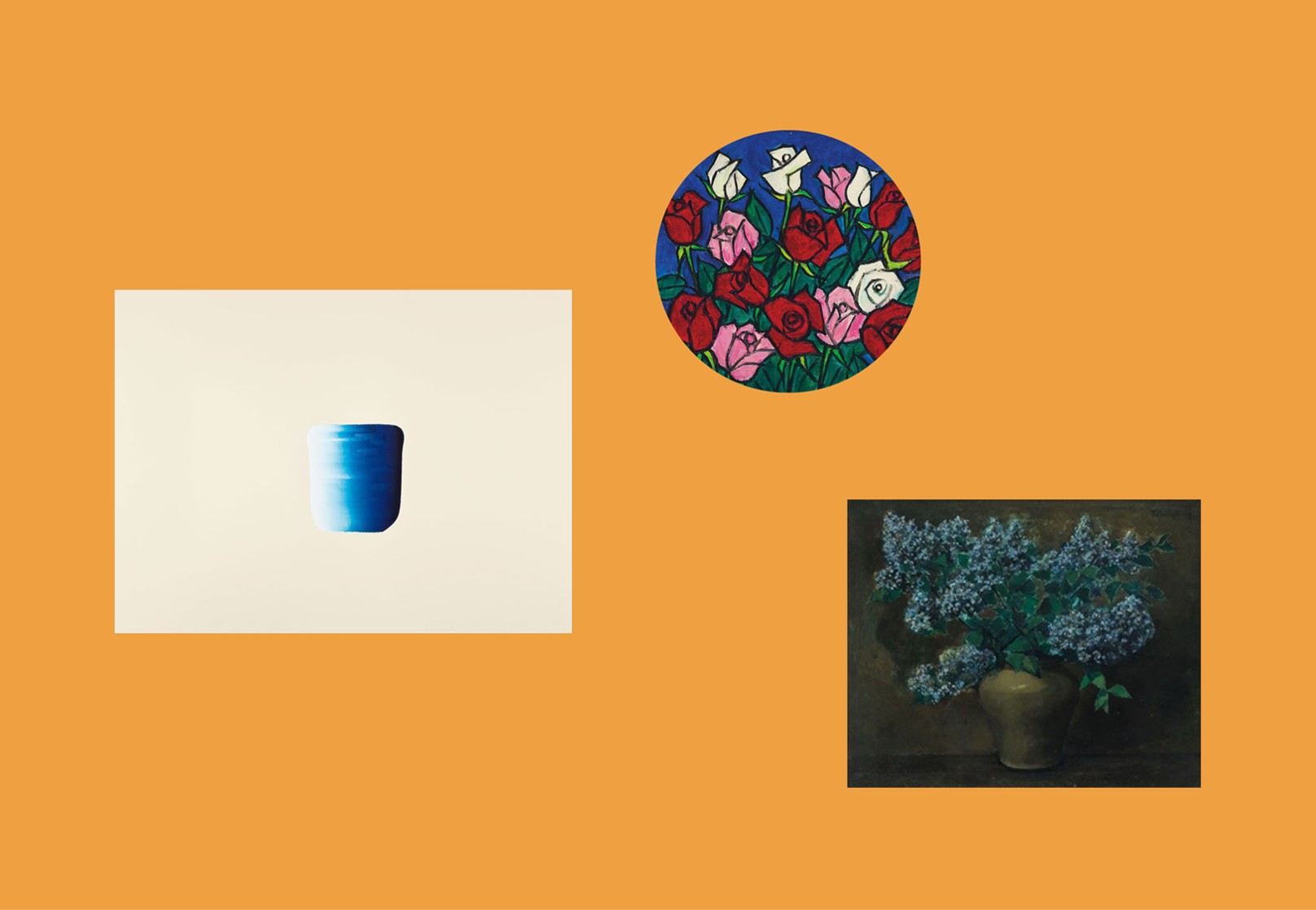

This result is

notable in that it did not rely on a single headline-grabbing, high-priced lot,

but instead reflected transactions distributed across multiple sections. The

auction was evenly composed of Korean modern and contemporary art,

international contemporary art, antiquities, and contemporary ceramics,

deliberately avoiding concentration in any single category. This approach can

be read as a response to recent market conditions in which demand had been

heavily skewed toward specific artists or narrow price brackets.

A painting by Yayoi Kusama, Pumpkin (AAT), was sold at Seoul Auction for KRW 720 million (approximately USD 497,000). / Photo : Seoul Auction

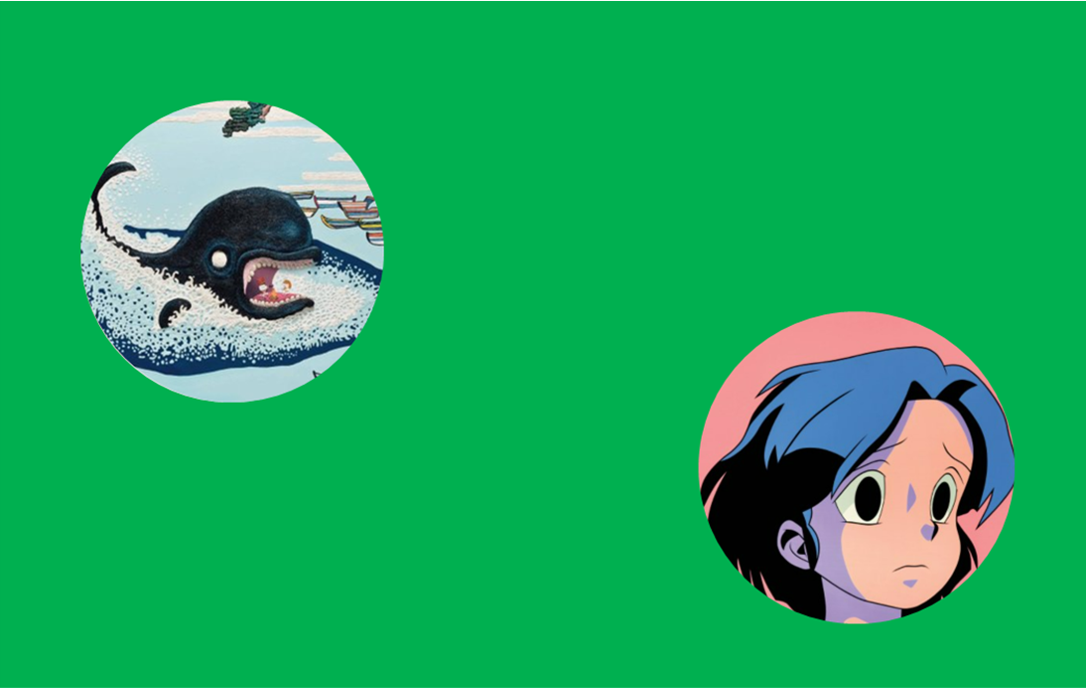

Among the notable

results, a painting by Yayoi Kusama achieved KRW 720 million (approximately USD

497,000), one of the highest prices of the sale. Among Korean artists, a work

by kukwon Woo sold for KRW 280 million (about USD 193,000), while a work by Kim

Sunwoo was hammered down at KRW 100 million (approximately USD 69,000).

The Steadfast Tin Soldier (2024) by Kukwon Woo, measuring 130 × 162.1 cm, was sold for KRW 280 million (approximately USD 193,000) at Seoul Auction. The work had an estimated price of KRW 200–260 million (approximately USD 138,000–179,000). / Photo : Seoul Auction

The overall

pattern observed at this Seoul Auction sale points less to symbolic

achievements driven by ultra-high prices and more to steady transactions

centered on mid-range price levels and artists whose market positions have

already been tested. This differs somewhat from the typical wait-and-see

posture often seen at early-year auctions, suggesting that after a

recalibration of price expectations, buyers were willing to commit to actual

purchases.

At the same time,

these results do not indicate that the market has entered a full-fledged growth

phase. Rather, they suggest that transactions have resumed in a limited but

more clearly defined range of prices and artists. In this sense, Seoul Auction’s

January sale functioned less as a barometer of renewed exuberance and more as a

checkpoint to confirm whether realistic pricing could translate into completed

transactions after the recent correction.

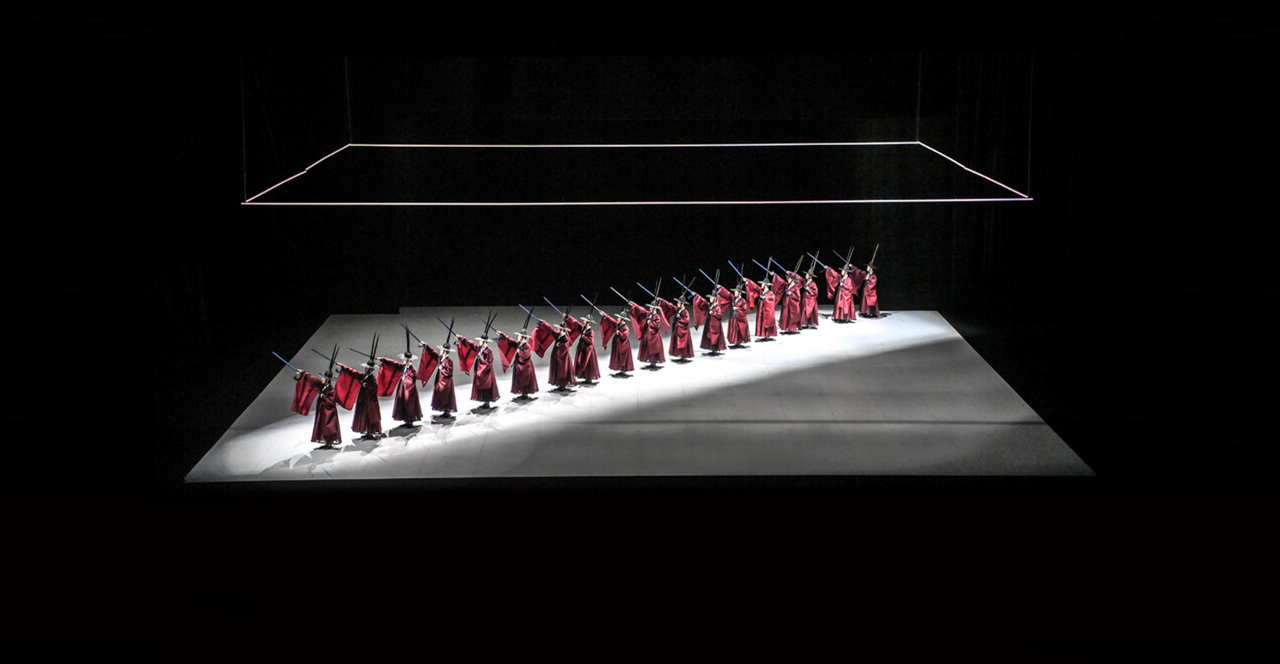

K Auction: A

Clear Focus on Blue-Chip Artists

K Auction held

its first regular auction of 2026 on January 28 at its Sinsa-dong headquarters.

A total of 92 lots were offered, with 66 sold, resulting in a sell-through rate

of 71.7 percent. Total hammer sales reached approximately KRW 6.9 billion (about

USD 4.76 million).

Although the

number of lots was smaller than at Seoul Auction, both the total value of works

offered and the total sales achieved were comparatively higher. The top price

of the auction was recorded by a work by Yayoi Kusama, which sold for KRW 980

million (approximately USD 676,000). This was followed by a large-scale

painting by Lee Ufan at KRW 890 million (about USD 614,000), and a 1970s work

by Kim Tschang-Yeul, which realized KRW 880 million (approximately USD

607,000).

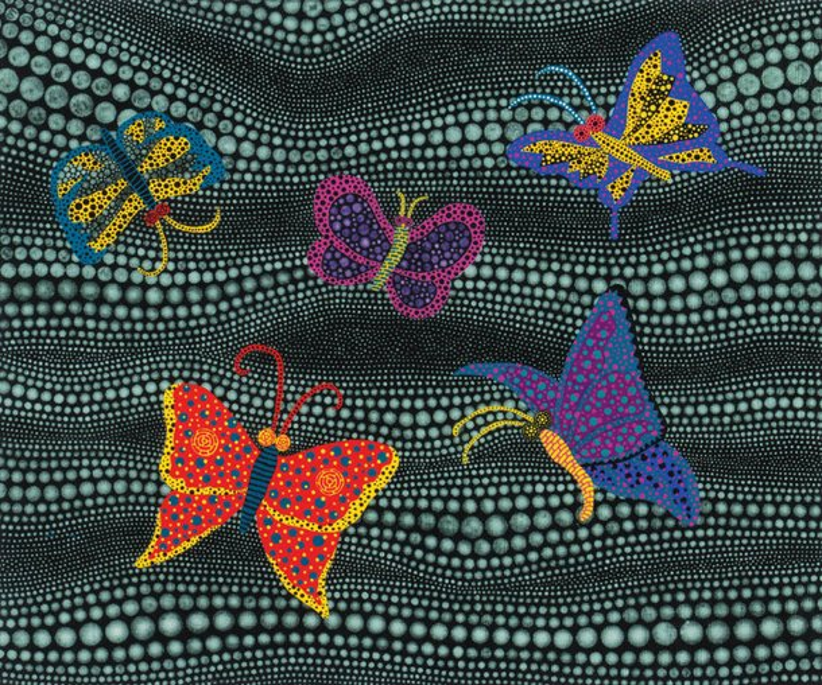

Butterflies “TWAO” by Yayoi Kusama was sold for KRW 980 million (approximately USD 676,000) at K Auction. / Photo : K Auction.

Water Drops ABS N° 2 (1973) by Kim Tschang-Yeul, oil on linen, 198 × 123 cm, was sold for KRW 880 million (approximately USD 607,000) at K Auction. The work carried an estimated price of KRW 900 million–1.4 billion (approximately USD 621,000–966,000). / Photo : K Auction

Works by Chun

Kyung-ja and Lee Seong-ja also found buyers, as did pieces by Yang Hae-gue and

Lee Bae, resulting in a sale structure in which both high-value and mid-range

works were successfully absorbed. Despite offering fewer lots, K Auction’s

strategy of concentrating on artists with well-established market credibility

contributed to its relatively strong total sales.

The most

distinctive feature of K Auction’s January results lies in the clarity of

demand concentration around a specific group of artists. A substantial portion

of the total sales was generated by internationally recognized, blue-chip

artists, underscoring the continued conservatism of collectors’ selection

criteria.

Beyond the

numerical sell-through rate, these results carry additional significance.

Compared to the early 2025 auctions—when bidding on high-priced works was

notably restrained—the January 2026 sale demonstrated that for representative

series and works from key periods, substantive transactions are once again

taking place. While this does not signal broad-based market expansion, it does

indicate that confidence in a core group of artists remains intact.

Overall

Assessment: Not a Recovery, but a Reordering

The January 2026

auction results at Seoul Auction and K Auction are premature to interpret as a

short-term rebound or a renewed upward cycle. Nevertheless, they carry clear

significance in showing that, after a prolonged period of adjustment, the

market has begun to reorganize its internal standards and redefine the

conditions under which transactions are possible.

Sell-through

rates in the 70 percent range, meaningful total sales, and transaction patterns

centered on blue-chip artists all indicate that the market is no longer in a

state of paralysis. At the same time, these outcomes confirm that participants

remain cautious, with demand focused on works that combine price realism with

accumulated market trust.

The January

auctions thus stand as an early case study of how the Korean art market may

move through 2026. Whether this selective, disciplined trading pattern

continues into the spring auction season and upcoming art fairs—or whether new

variables emerge—will require continued observation.