This final installment of《Korea Art Market 2025》summarizes the

condition of the Korean art market in 2025 by sector, based on the

report’s market analysis, and considers prospects for the period ahead.

A synthesis of the key indicators presented in《Korea Art Market 2025》suggests that the

simultaneous downturn observed across auctions, galleries, and art fairs cannot

be explained simply as a cyclical economic slowdown. Rather, the analysis

persuasively argues that the conventional growth model that characterized the

Korean art market over the past decade has reached its limits, with the

consequences of this structural exhaustion becoming concentrated over the

course of this year.

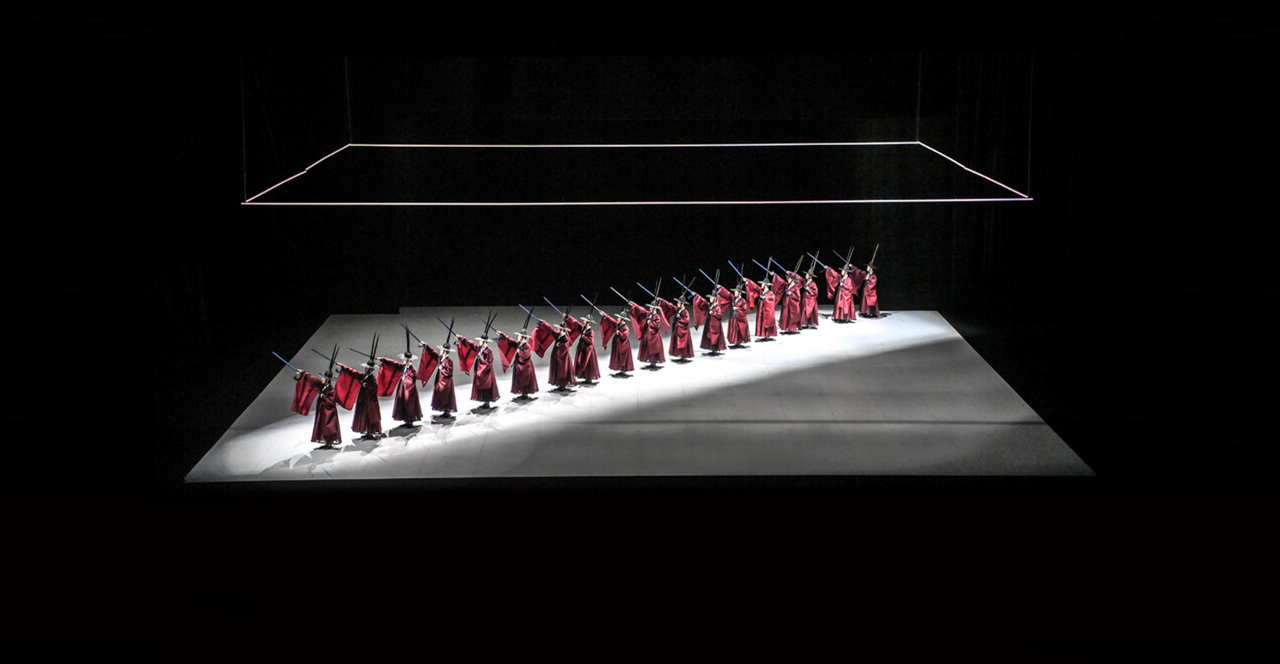

The Auction Market: From Short-Term Trading

to Long-Term Holding

In 2025, the domestic auction market showed a

clear decline. Total annual hammer sales fell sharply from the previous year,

dropping to levels even lower than those seen in the early stages of the

pandemic. This contraction, however, is not unique to Korea, but aligns with

the broader downturn affecting the global auction market as a whole.

Seoul Auction in session / Photo: Seoul Auction

That said, the internal dynamics reveal a more

nuanced picture than a simple contraction. In certain price segments,

transaction volumes were maintained or even increased slightly, while among

major artist groups, short-term trading declined and was replaced by transactions

premised on long-term holding. In effect, speculative demand has

receded, giving way to a more conservative collecting attitude.

The report interprets this not as a collapse of

the auction market, but as a transformation in trading behavior. Rather than

focusing on the timing of a price rebound, it suggests that closer attention

should be paid to the ongoing reconfiguration of market structure.

Galleries: The Limits of Expansion-Driven

Strategies

In the gallery sector, the sense of contraction

was even more pronounced. Many galleries experienced declining revenues,

leading to reductions in operational scale or adjustments in art fair

participation. A growing number have also begun reassessing staffing structures

and fixed costs.

Within the industry, these shifts are

increasingly viewed not as short-term responses to an economic downturn, but

as signals that expansion-oriented operating models have become unsustainable.

In this sense, 2025 marks a turning point rather than a temporary setback.

An installation view of Cylinder Gallery, one of the emerging galleries currently active on the international scene, at Frieze London / Screenshot from Cylinder Gallery’s Instagram.

By contrast, a smaller group of galleries

demonstrated relatively stable performance. These galleries shared a common

approach: moving away from a supply-driven, artist-centered logic toward strategies

oriented around collectors.

Those that recalibrated exhibition planning,

pricing structures, and communication methods to align with changing collector

preferences and purchasing patterns were able to maintain greater stability

despite unfavorable market conditions.

The report characterizes 2025 as “a year in

which galleries paused their growth strategies and began to reconfigure their

operational foundations.”

Art Fairs: The End of the “Attend More”

Strategy

Even amid the contraction of auctions and

galleries, art fairs continued to function as key distribution channels. At

several major fairs, visitor numbers increased, and while limited, tangible

sales results were confirmed. In particular, the influx of younger collectors

emerged as a positive variable for the market.

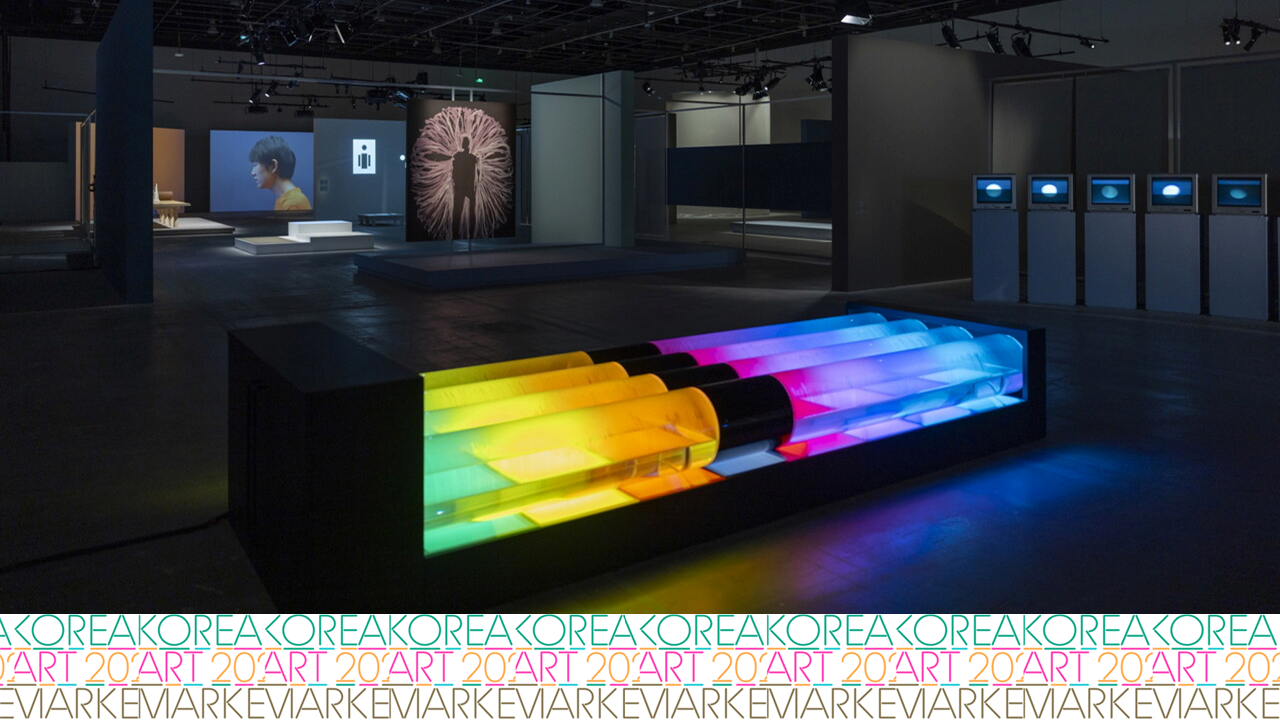

Kiaf 2025 Exhibition Scene / Photo: Kiaf

Power 20: Influence Remains Concentrated in

Individuals

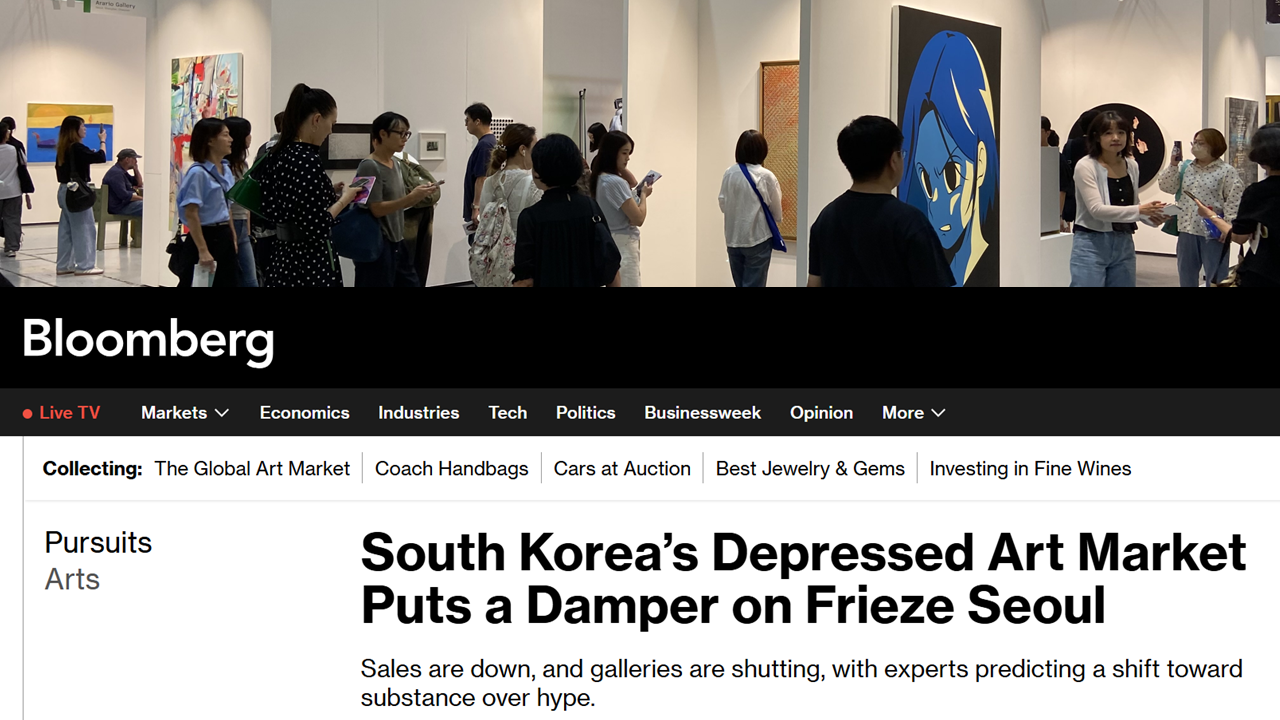

The《Korea Art

Market Power 20》list included in the 2025 report

offers a revealing snapshot of the current structure of influence within the

Korean art market.

Taking into account not only capital scale and

transaction volume, but also network-building capacity, institutional impact,

and the ability to shape discourse, the list identifies those who

exert real influence over the market.

One striking feature is that influence

remains centered on individuals rather than consolidated within institutions or

organizations. Figures who move fluidly across galleries, institutions,

curatorial practice, and policy domains continue to play a decisive role.

From left: Hong Ra-hee (Honorary Director, Leeum Museum of Art), Tina Kim (Tina Kim Gallery), Do Ho Suh (artist), Patrick Lee (Director, Frieze Seoul), RM (BTS).

This indicates that the Korean art market still

relies heavily on personal judgment and relational networks rather than

institutionalized systems. The report assesses this condition as one that “combines

the advantage of flexibility with inherent structural vulnerability.”

Promotional image for Frieze Seoul 2026 / Courtesy of the Frieze website.

Closing 2025

On December 18, the five-year extension

of Frieze Seoul was formally confirmed. This decision is widely

interpreted as a sign that Seoul is no longer viewed as a site for short-term

events within the Asian art market, but rather as a mid- to long-term hub. It

underscores the continued strategic relevance of the Korean market within the

international art world.

Nevertheless, this development should not be

read straightforwardly as a signal of market recovery. Many in the field regard

the extension as having “bought time.” Over the next five

years, outcomes will depend heavily on how effectively internal foundations are

strengthened—through institutional reform, the development of digital archives,

the cultivation of professional expertise, and the education of collectors.

In conclusion, while the《Korea Art Markt 2025》was undeniably subdued,

the report suggests that this year should not be recorded simply as one of

decline. Rather, it may be understood as a period in which the market

adjusted its pace while preparing for the next phase.

Ultimately, the question posed by《Korea Art Markt 2025》points toward 2026 and

beyond, emphasizing that only through professional decision-making aligned with

global standards and reform-oriented execution that overcomes existing

limitations can the market move closer to meaningful answers.

Source

(Download):《Korea Art Markt 2025》(Seoul National University Business Research Institute · Paradise

Cultural Foundation, 2025).