In July 2025, Korea’s two leading

art auction houses, K Auction and Seoul Auction, held their offline sales. Both

recorded sell-through rates around 70%, showing a numerical recovery compared

to the first half of the year. However, the structure of the artists presented

and the transaction patterns remained repetitive.

High-value, premium works were

limited in availability, and there were no initiatives to introduce or promote

new-generation artists who could lead the future art market. Instead, the

auctions focused on safe, well-known names and mid-priced, lesser works.

K Auction

Total Hammer Price: 4.7 billion KRW

(approx. 3.41 million USD)

Sell-through Rate: 68.4%

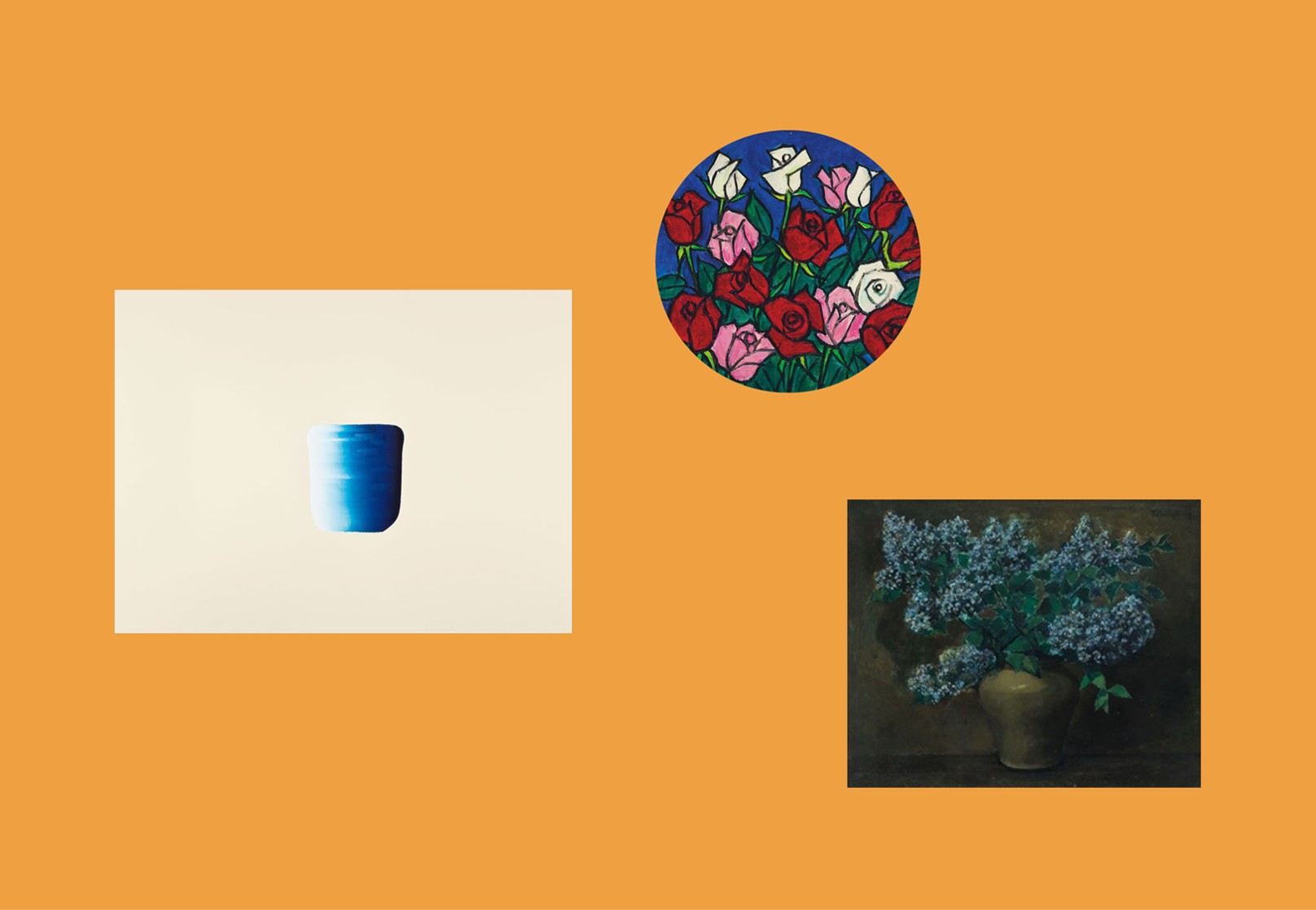

Top Lot: Kim Whanki’s Jar at 900 million KRW (approx.

652,000 USD)

Held on July 23, K Auction's

offline sale included 104 lots, of which 6 were withdrawn just before the

auction. Out of the remaining 98 lots, 67 were sold, resulting in a

sell-through rate of 68.4%. The modern and contemporary art section saw 73 lots

with 52 sold (71.2%, 4.2 billion KRW / approx. 3.04 million USD). The

traditional Korean painting section recorded a 60% sell-through with 15 out of

25 lots sold, totaling approximately 400 million KRW (approx. 290,000 USD).

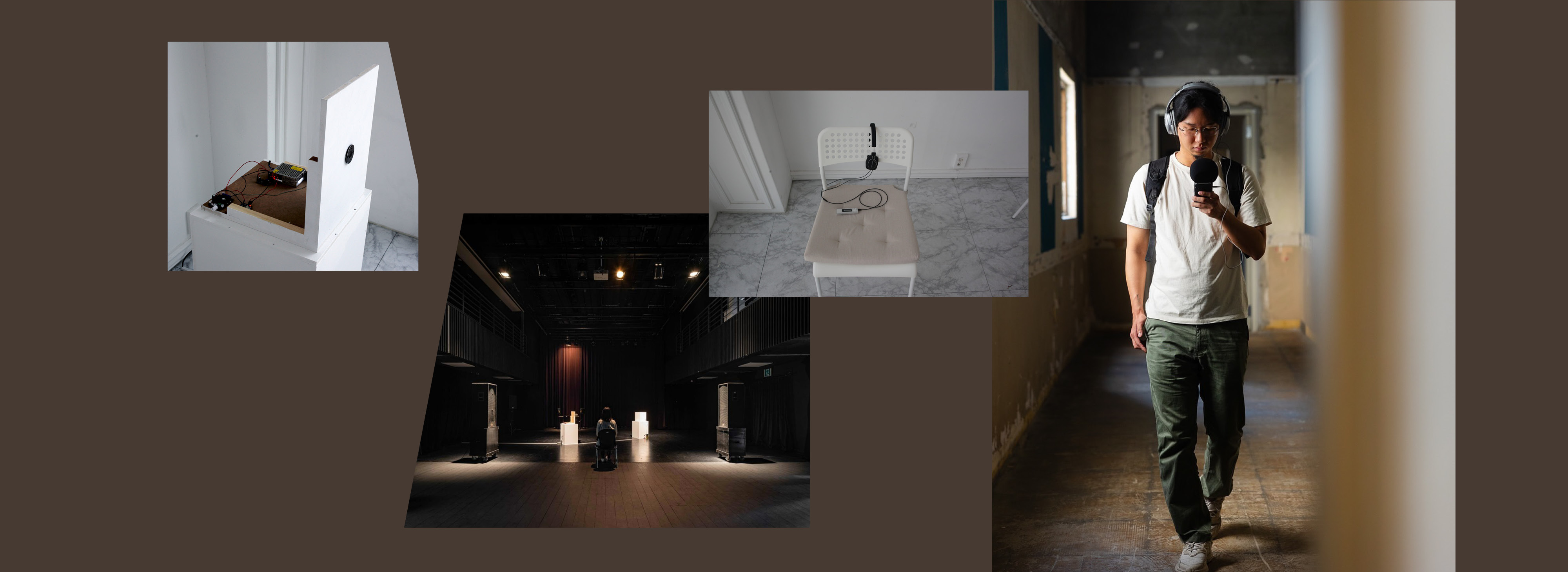

Kim Whanki’s Jar (1958), sold for 900 million KRW (approx. 652,000 USD). / Courtesy of K Auction

The top-selling work was Kim

Whanki’s Jar, hammered down at 900

million KRW (approx. 652,000 USD), 50 million KRW below the initial

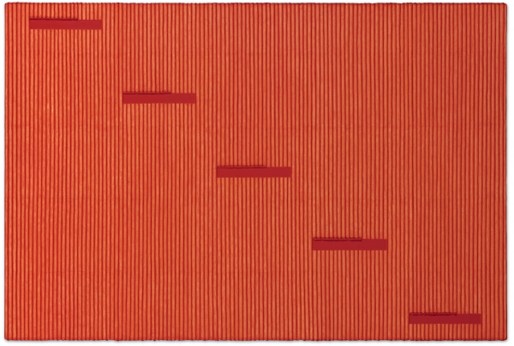

estimate. Park Seo-bo’s Ecriture No. 080831

sold for 400 million KRW (approx. 290,000 USD), and Yun Hyong-keun’s Untitled

fetched 230 million KRW (approx. 167,000 USD). Lee Bae’s Brushstroke

4-75 started at 85 million KRW and sold for 125 million

KRW (approx. 91,000 USD). Another Untitled

work by Kim Whanki started at 60 million KRW and was sold for 92 million KRW

(approx. 67,000 USD).

Yun Hyong-keun’s Untitled (1988–1991), sold for 230 million KRW (approx. 167,000 USD). / Screenshot from K Auction website

Park Seo-bo’s Ecriture No. 080831 (2008). / Courtesy of K Auction

Works by Chung Sang-hwa, Lee

Kang-so, Chun Kwang-Young, and Jonas Wood mostly sold near or below their

starting prices. Lee Ufan’s 150-sized piece Correspondence

was withdrawn before the auction began. Although some competition was observed,

many lots sold at adjusted or minimum starting prices.

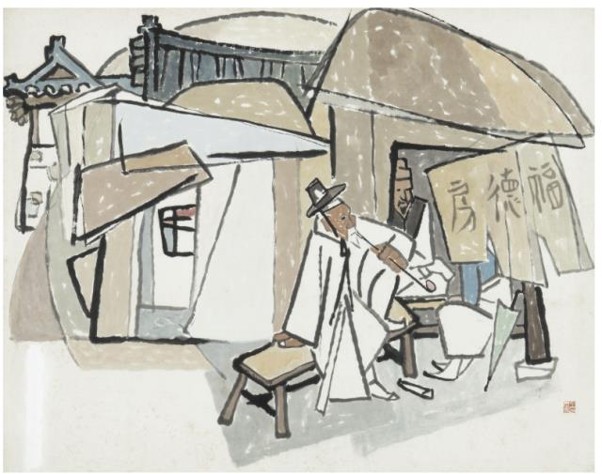

In the Korean traditional art

section, all six works by Unbo Kim Ki-chang were sold. Real

Estate Office was hammered down at 1.2 billion KRW

(approx. 870,000 USD) after starting at 35 million KRW. Chrysanthemum

and Bottle of Sake / Orchid and Vase was sold for 13

million KRW (approx. 9,400 USD), and Park Rae-hyun’s piece fetched 110

million KRW (approx. 80,000 USD) from a starting price of 42 million

KRW.

Unbo Kim Ki-chang’s Real Estate Office(1953–1955). / Screenshot from K Auction website

Overall, the auction centered on

mid-sized, mid-value works by familiar artists. Price adjustments and

conservative curation helped secure stable results, but no new artist segments

or market-expanding strategies were observed.

Seoul Auction

Total Hammer Price: 3.3 billion KRW

(approx. 2.39 million USD)

Sell-through Rate: 71.0%

Top Lot: Lee Ufan’s Dialogueat 670

million KRW (approx. 486,000 USD)

Held on July 22, Seoul Auction’s

Contemporary Art Sale featured 77 lots, 8 of which were withdrawn. Of the 69

presented, 49 were sold, marking a sell-through rate of 71.0% and a total

hammer price of 3.3 billion KRW (approx. 2.39 million USD). This marked

the first time since May 2024 that Seoul Auction exceeded a 70% sell-through

rate, and the first time in 14 months that the unsold rate fell below 30%.

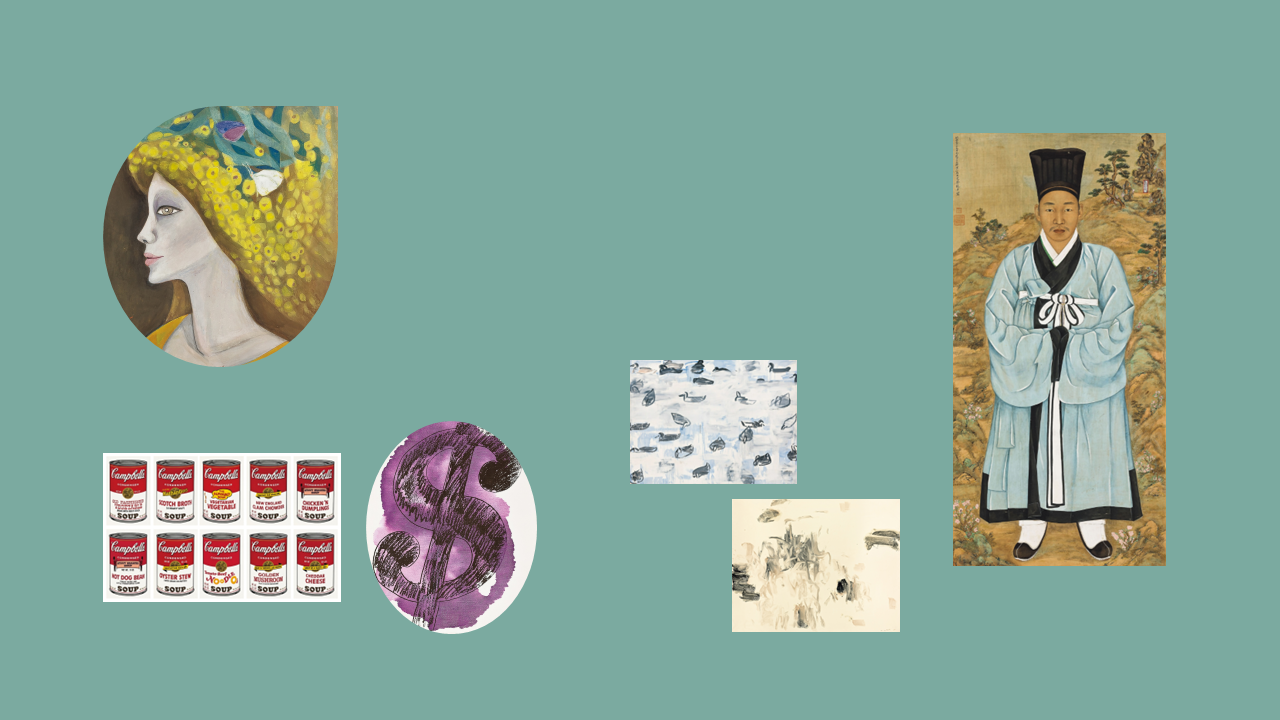

The auction featured a themed “Blue

Section” composed of blue-toned artworks, accompanied by dress code events and

gift giveaways at the venue. While 10 out of 28 lots in the Blue Section went

unsold, the auction overall maintained stable results by minimizing unsold

lots.

Lee Ufan’s Dialogue (2007), initially estimated at 650–1,000 million KRW (approx. 476,400–733,000 USD), sold for 670 million KRW (approx. 486,000 USD). / Screenshot from Seoul Auction website

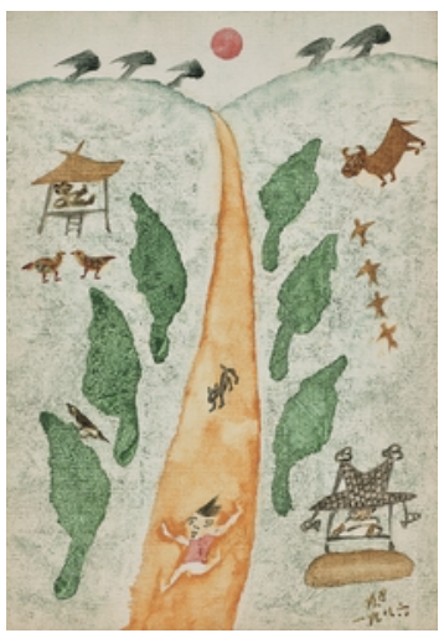

The top-selling work was Lee Ufan’s

Dialogue, which sold for 670 million

KRW (approx. 486,000 USD). Jang Uk-jin’s The Road

started at 80 million KRW and sold for 135 million KRW (approx. 98,000 USD).

Chun Kyung-ja’s Landscape surpassed its

high estimate and sold for 89 million KRW (approx. 64,500 USD). Ugo

Rondinone’s piece was hammered at 250 million KRW (approx. 181,000 USD),

while Yoo Young-kuk’s Twilight sold for

a reduced price of 400 million KRW (approx. 290,000 USD). Andy Warhol’s Flowers

fetched 63 million KRW (approx. 45,600 USD).

Yoo Young-kuk’s Twilight (1979), sold for 400 million KRW (approx. 290,000 USD). / Courtesy of Seoul Auction

Jang Uk-jin’s The Road, sold for 135 million KRW (approx. 98,000 USD). / Screenshot from Seoul Auction website

Two ceramic works by Lee Ufan

started at 12 million and 11 million KRW, and sold for 20 million and 18.5

million KRW (approx. 14,500 USD and 13,400 USD). Works by Kim

Whanki, Yun Hyong-keun, and Yoshitomo Nara were withdrawn prior to the auction.

High-value lots were generally limited, and adjusted starting prices

contributed to the overall sell-through success.

Repetition in Curation, Absence of

Strategy for Future Market Artists

Both K Auction and Seoul Auction

adopted conservative curatorial strategies aimed at aligning with current

market demand. However, the artists featured remained largely familiar, and no

initiative to discover or promote artists capable of leading the next

generation of the art market was observed.

As both sellers and buyers prefer

lower risk in a slow market, the auctions reinforce a cyclical structure

reliant on established names, further delaying structural transformation.

Conclusion

Despite improved sell-through

rates, the July auctions appear to reflect calculated curatorial adjustments

and reduced supply rather than a meaningful recovery in market demand.

What the Korean art market needs

now is not simply numerical rebound, but long-term strategies to identify and

promote artists who can redefine the next decade of collecting. Without clear

direction during market downturns, the industry will remain stuck in a

repetitive loop, unable to escape stagnation.