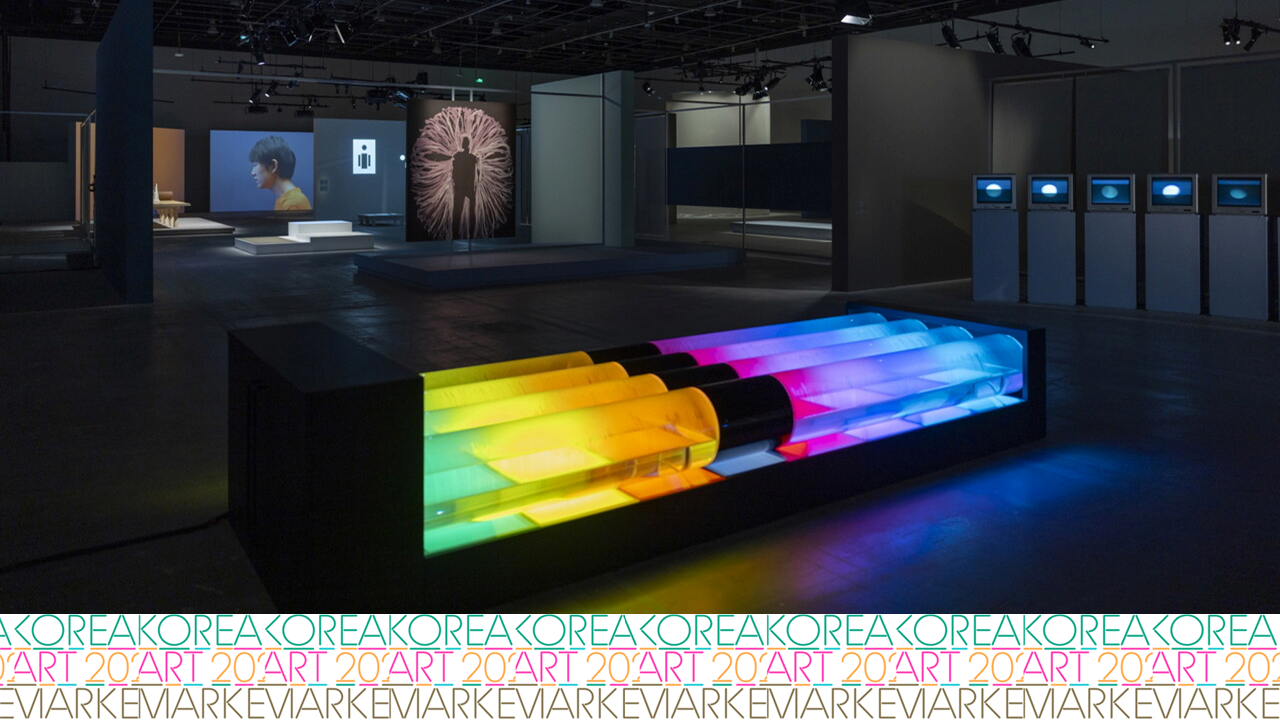

The second

chapter of《Korea Art Market 2025》 focuses on the question of how galleries have adapted

to survive.

After a brief recovery in 2024, the market cooled again in early 2025. Yet the

report diagnoses this period not as a regression, but as “the

beginning of a structural transition.”

Beyond

Cost-Cutting: Preserving Relationships

Among the 26

galleries surveyed, 57.7% reported a decline in annual sales,

and more than half (53.9%) anticipated further decreases.

In response, 53.8% reduced art-fair participation, 30.8% cut

the number of exhibitions, and 23.1% downsized staff.

However, only 11.5% reduced the number of represented artists—showing

that most prioritized maintaining artist relationships over cutting costs.

According to

curator Jung Yu-jin of the Paradise Foundation, “The

criteria for survival have shifted from revenue to trust. Protecting artists

ultimately means protecting the market itself.”

Refocusing

Domestically, Cautious Abroad

The operational

focus of galleries has been clearly realigned.

69.2% emphasized domestic client development, 65.4%

prioritized artist and program planning, and 57.7% listed cost

management as key tasks.

By contrast, overseas client development (42.3%) and new

art-fair participation (7.7%) dropped in priority. In a volatile

global economy, most opted for consolidation rather than expansion.

A representative

from Kukje Gallery noted in the report: “Maintaining the

quality of exhibitions in Seoul has become more important than pursuing

expansion to New York or London. 2025 is the year of settling, not stretching.”

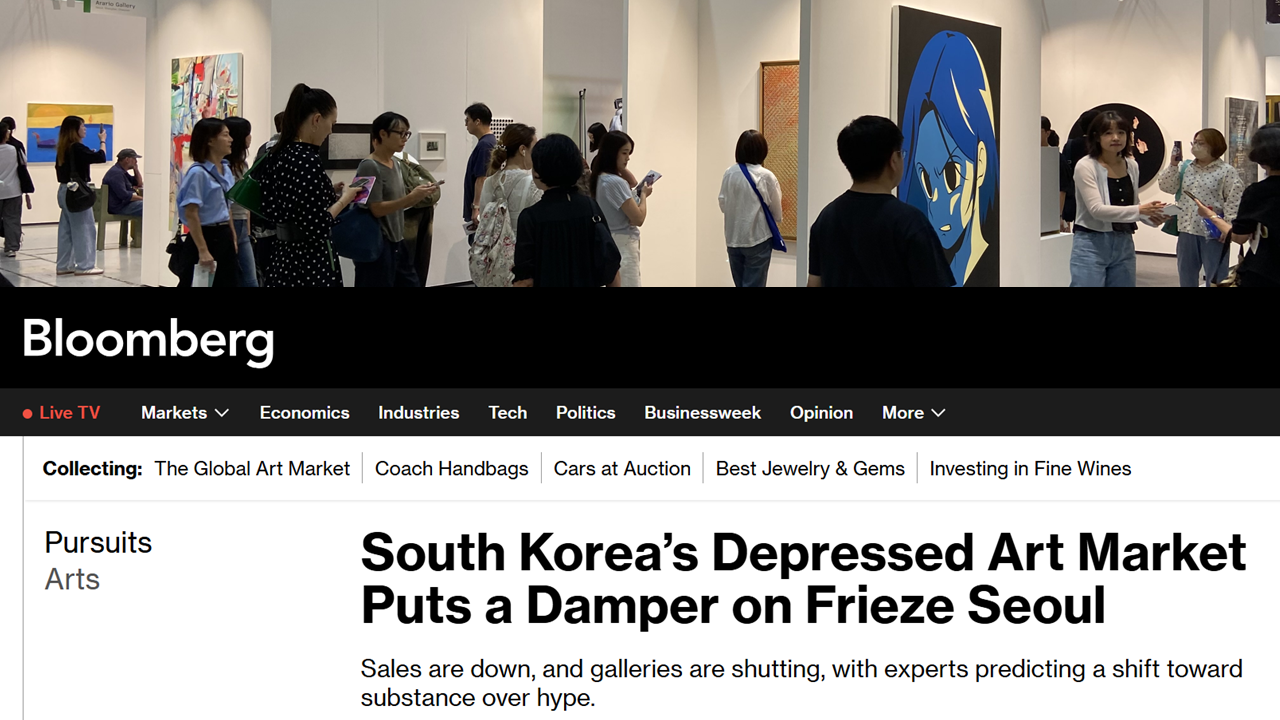

Polarized

Sales and the Return of the Mid-Range Market

While 61.5%

of galleries reported a decrease in average artwork prices, this

was not simply a sign of stagnation but of Market realignment.

Transactions above KRW 1 billion declined sharply, whereas sales

between KRW 100 million and 500 million increased, marking the return

of the mid-range segment.

Researcher Hong

Ye-rin interprets this as evidence that “long-term collectors are

replacing speculative buyers.” This shift benefits both established and

emerging artists.

Galleries such as The Page Gallery and Gallery

Baton have stabilized demand by focusing on young painters and

sculptors—building what they describe as “structures that share the artist’s

timeline of growth.”

Generational

Shift and the Market of Taste

In 2025, 57.7%

of respondents observed a rise in purchases by collectors under 50.

This generation—often educated abroad and digitally literate—values artists’

narratives and worldviews over investment returns.

Professor Lee

Hyun-woo of Seoul National University comments: “A gallery’s

success now depends less on price and more on narrative. The artist’s

philosophy, online presence, and immersive exhibitions increasingly drive

purchases.”

These younger

collectors see exhibitions not as “viewing” but as “participating.” They act

simultaneously as fans, patrons, and co-curators—reshaping the gallery model

around relationships rather than transactions.

Platform

Transition and a New Branding Logic

Instagram remains

the dominant promotional channel (96.2%), yet the use of official websites has

declined, while reliance on art magazines and professional media

has grown. The emphasis of communication has shifted from speed to credibility.

Since 2025, many Korean galleries have begun producing artist content in

collaboration with independent critics and writers, reinforcing a sense of

cultural authority.

The report

defines this as “a transition from short-term marketing toward the accumulation

of brand trust.”

In other words, quality of content has become the core metric of

survival.

The report also

highlights the need to strengthen in-house marketing systems

and reduce dependency on global platforms such as Ocula and Artsy,

identifying self-built digital infrastructure as a prerequisite for the

internationalization of Korean contemporary art.

Policy and

Structural Outlook

Professor Joo

Yeon-hwa of Hongik University, who led the gallery survey, writes

that “2025 marks the first visible stage of structural innovation

in Korean galleries.”

She emphasizes the urgency of building a collaborative ecosystem—including

public support for small and mid-sized galleries, digital archiving

infrastructure, and shared artist databases.

Researcher Kim

Min-seok of the Seoul National University Institute of Management

echoes this view: “Galleries are no

longer mere distributors of artworks. They are custodians of cultural assets. Sustainability depends not on market efficiency, but on the density of

relationships.”

From Survival

to Sustainability

“Galleries

reduced spending but preserved relationships. That choice became the turning point in transforming the market’s foundation.”

This is how《Korea Art Market 2025》concludes its chapter on gallery operations.

Galleries have

held onto their artists, collectors have chosen taste over speculation, and the

market’s center has shifted from money to meaning,

from survival to sustainability.

As Kim Min-seok writes, “The cold wave of 2025 is not an end, but

the beginning of a reconfiguration.”

The survey

included 25 major commercial galleries across Korea,

representing a broad spectrum of the art ecosystem—from leading Seoul

institutions to regionally anchored and internationally networked galleries

such as Arario Gallery, BAIK Art, BHAK, Cylinder, Duruartspace,

Gallery Chosun, Gallery FM, Gallery Hyundai, Gallery MEME, Gallery Shilla,

Gallery Sklo, Gallery We, Gana Art, Hakgojae, Jason Haam Gallery, Keumsan

Gallery, KIDARI Gallery, Kukje Gallery, P21, PKM Gallery, Sun Gallery,

Thaddaeus Ropac, ThisWeekendRoom, UM Gallery, and Wooson Gallery.

This composition

captures the full spectrum of Korea’s gallery landscape, balancing established

blue-chip entities with emerging and regionally based spaces.

Source (Download): Korea Art Market 2025 (Seoul National University Business Research Institute & Paradise Cultural Foundation, 2025).

Research

and Analysis: Prof. Joo Yeon-hwa (Hongik University Graduate

School of Arts Management)