Seoul Auction in session / Photo: Seoul Auction

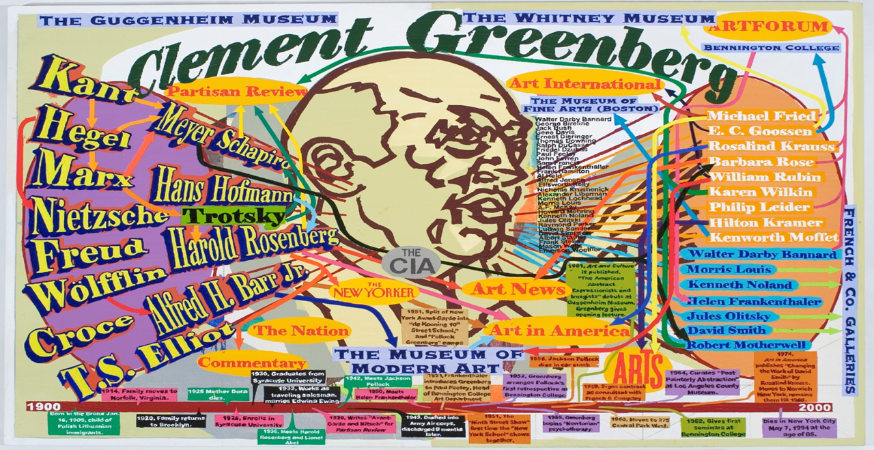

The fourth chapter of 《Korea Art Market 2025》 examines

structural changes in Korea’s art auction sector. The report characterizes 2025

as “a turning point from auctions centered on simple sales to auctions centered

on discourse and narrative.” While total sales volume has slowed, the high-end

market is giving way to the mid-tier range, and significant qualitative changes

are emerging in bidder profiles and artwork supply channels.

Seoul Auction Preview Exhibition / Photo: Seoul Auction

Scale Remains Uncertain, but Structural

Reconfiguration Accelerates

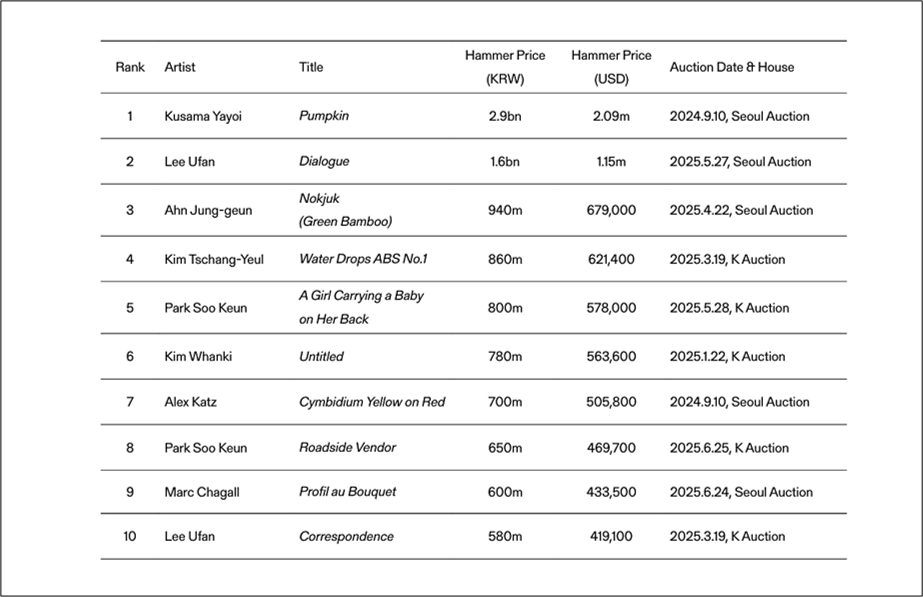

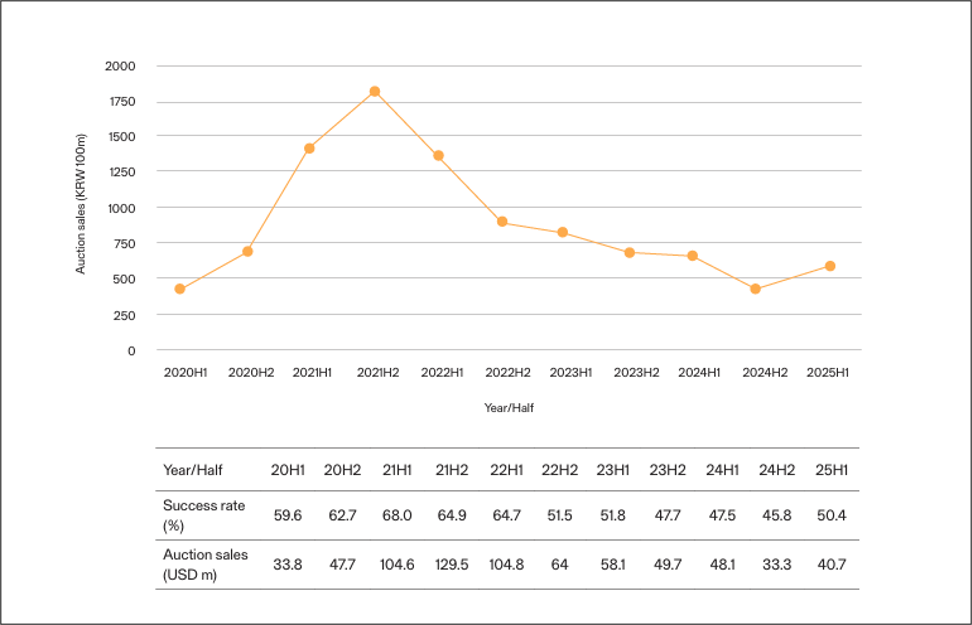

According to the report, Korea’s major auction

houses recorded a year-on-year decline in total sales, yet signs of recovery

and structural realignment appeared simultaneously. Total auction sales reached

approximately KRW 46.1 billion in the second half of 2024, rising to about KRW

56.4 billion in the first half of 2025—an increase of 22%.

Meanwhile, the share of ultra-high-value works

(over KRW 1 billion) declined, while sales of mid-range works priced between

KRW 100 million and 500 million increased. Rather than signaling market

contraction, this shift is interpreted as a restructuring process—a

movement away from speculative buying and toward more stable, long-term

collecting. The report views this trend as evidence that speculative high-end

demand is receding and a more sustainable collector base is expanding.

Top 10 Auction Results in Korea, Second Half of 2024–First Half of 2025

Auctions Evolve from Sites of Sale to Sites

of Narrative

Another shift highlighted by the report is the

changing intention of auction participants. Many respondents now regard

auctions not simply as venues to purchase high-priced works, but as

opportunities to explore artwork narratives, evaluate artistic value, and

connect with collections.

Auction Success Rates and Total Sales by Half-Year (Unit: %, USD m

1 USD = 1,384 KRW, exchange rate as of 26 July 2025 https://wise.com/

Participation by Millennial and Gen Z collectors

continues to rise. These collectors place greater emphasis on artist talks,

collection context, and event-based experiences prior to purchase decisions.

The question is no longer “Who bought it?” but “What is the work?” This shift

has transformed auctions into storytelling platforms

that contextualize an artist’s career and the internal logic of a work, rather

than merely sites of price competition. The report concludes: “Auctions are no longer arenas of transaction

but hubs of value and relational networks.”

Moment of winning bid for Yoo Young-kuk’s work, 2019 / Photo: K Auction

The report summarizes these transformations into

three major structural changes:

1. Reconfiguration of Price Bands

The portion of ultra-high-priced works has diminished, while mid-tier works

(KRW 100 million–500 million) now occupy a larger share. This shift reflects a

retreat from speculative buying and a growing emphasis on long-term collection

building.

2. Changes in Bidder and Collector

Demographics

Participation by MZ-generation and experience-oriented collectors is rising.

These groups prioritize engagement over acquisition; narrative exploration,

event participation, and shareable moments at the auction site increasingly

influence their collecting decisions.

3. Diversification of KPI Metrics

Instead of assessing performance solely through total sales volume, new KPIs—such

as bidding participation rates, re-bidding rates, social media mentions, and

post-auction event participation—are becoming crucial. The auction sector is

entering an era where experience and relationship-building matter

as much as short-term financial results.

Tasks for a Sustainable Auction Ecosystem

The report proposes three key tasks for ensuring

long-term sustainability in Korea’s auction market.

1. Enhancing market access for emerging and

mid-career artists and small-to-mid-sized auction houses

A market overly concentrated in high-value works risks shrinking diversity

among artists and auction operators. The report calls for greater support—such

as subsidized participation fees, dedicated mid-tier sections, and stronger

representation of emerging artists.

2. Strengthening linkages with urban and

global cultural infrastructures

Auctions must evolve from one-off events into platforms integrated with urban

cultural and tourism ecosystems. This requires expanded models such as

collector lounges, exhibition-linked programming, residencies, and partnerships

with local cultural institutions.

3. Establishing data-driven systems and

transparency

To compete internationally, Korea’s auction sector needs systematic

accumulation and disclosure of bidding and sale data. The report emphasizes

reducing dependence on foreign platforms and building a domestic data

infrastructure—essential for safeguarding the autonomy and long-term

competitiveness of Korea’s art market.

Conclusion

《Korea Art Market 2025》 concludes: “In 2025, auctions have evolved beyond simple

marketplaces where artworks change hands; they have become discursive spaces

where artists, collectors, and the market form relationships.”

As cities shift from commerce-driven to

experience-driven environments, audiences move from consumers to participants.

Auctions, too, are transitioning from the “language of transaction” to the “language

of relation.” To build a sustainable ecosystem, the auction sector must

continue expanding into a platform where art, industry, and urban culture

intersect.