This series is based on the report 《Korea

Art Market 2025》, jointly published by the Seoul

National University Institute of Management Research and the Paradise Cultural

Foundation, and examines the current landscape and future direction of the

Korean contemporary art market across five installments.

The first article, “Recession or

Transition?”, diagnoses the overall trends and structural changes in the

market; the second explores “The Survival Strategies Chosen by Galleries”; the

third focuses on “The Transformation and Role of Art Fairs”; the fourth

analyzes “The Restructuring of the Auction Market”; and the final installment, 〈Power

20: The Map of Influence in Korean Art〉, investigates

the emerging order and dynamics shaping Korea’s art market today.

《Korea Art Market 2025》 Cover Page

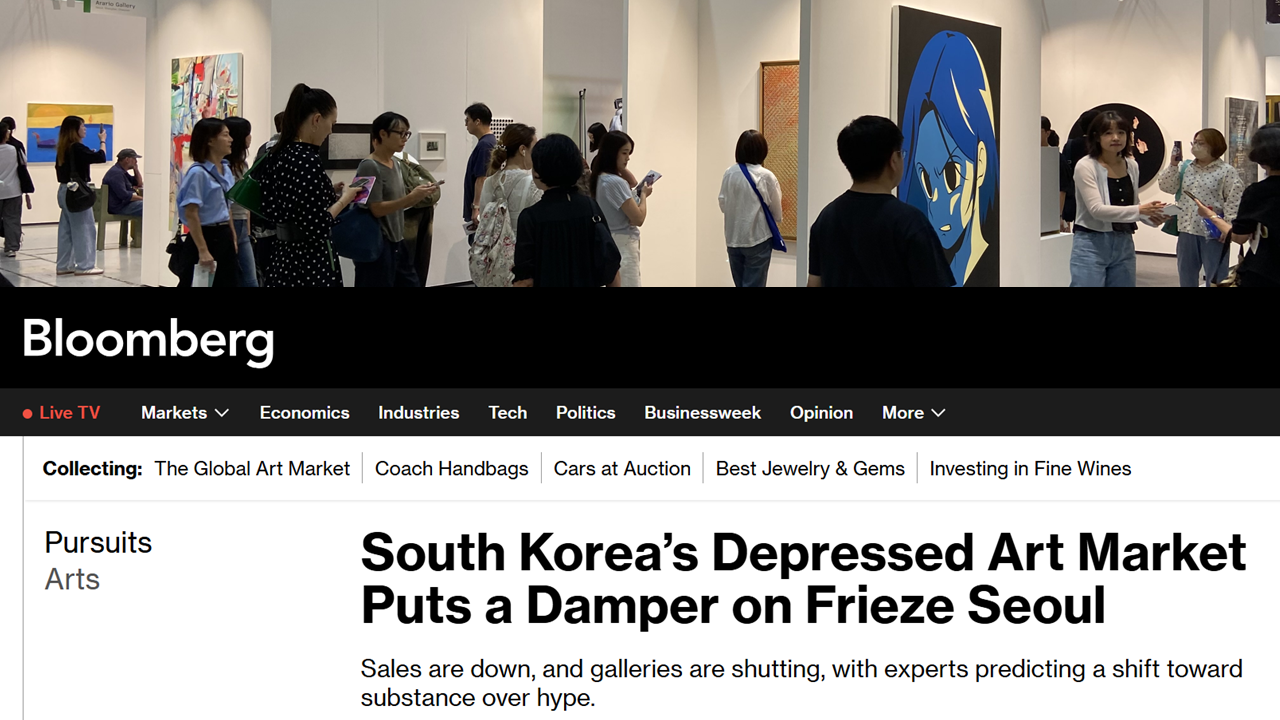

If one phrase were to express the 2025 Korean art market it

would be ‘a cold wave.’ Auction success rates, gallery sales, art fair

transaction volumes—all indicators are on the decline; this year the market has

literally frozen.

Yet the 《Korea Art Market 2025》 report

diagnoses that beneath the surface of this downturn “a transformation of

infrastructure is underway.” It is not a mere short-term recession but a

process of reconfiguration into a new ecosystem.

Kim Min-seok, research fellow at the SNU Business Research

Institute and general editor of the report, states, “2025 is not the retreat of

the market but a turning point in its language,” analysing that “the

investment-centred art market is shifting into a taste-centred market; the

aesthetics of ownership are moving into the aesthetics of relationship.”

Surface of the cold wave, depth of the transition

Among 26 major domestic galleries, 57.7 % reported decreased sales

compared to the previous year. Although many reduced exhibition

numbers and art-fair participation, few said they had reduced the number of

exclusive artists. Rather, 76.9 % of galleries maintained or

increased their number of exclusive artists.

(Left) Question about the three most important areas in gallery operation / (Right) Question about gallery operating costs

In light of this

result, curator Jeong Yu-jin of the Paradise Cultural Foundation explains, “Galleries

chose survival criteria focused on maintaining relationships with their artists

rather than simply cutting costs.”

This shift is

altering the central question of the market. Whereas in the past the core was ‘who

buys the artworks?’, now it is ‘with whom do we build relationships?’

Professor Lee

Hyun-woo of the SNU Culture Industry Policy Center adds, “Value is now formed

not through sales mediated by exhibitions but through the artist’s narrative,

their social-media activity, and the audience’s experience.”

Floor of the

auction market, return of middle price range

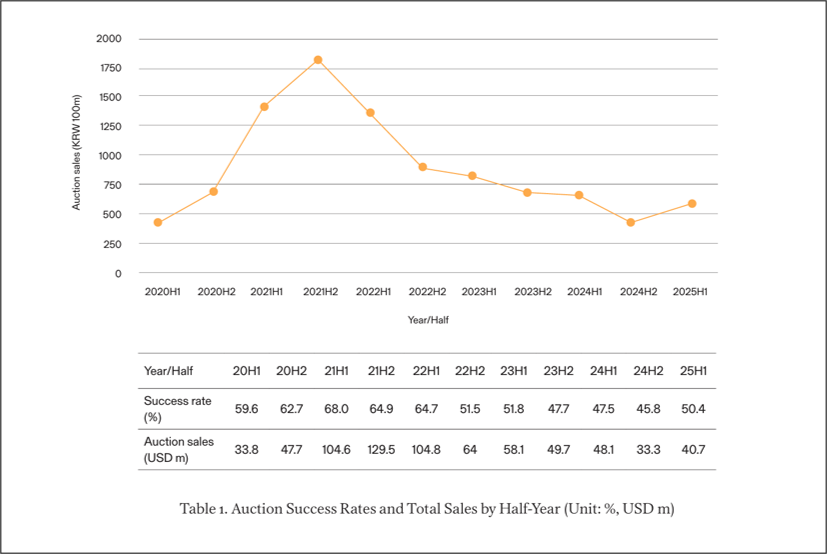

This year the report shows through auction data the underlying change

in the market’s strata.

In H2 2024 South

Korean auction total value was KRW 46.1 billion (≈ USD 33.3 million) hitting a post-pandemic low; in H1 2025 it

rebounded to KRW 56.4 billion (≈ USD 40.7

million) up 22 %. The success

rate also recovered to 50.4 %.

Research fellow

Park Ji-hoon describes this as “not a temporary spike but a sign that a

re-adjustment of transaction structure is occurring.”

Auction Success Rates and Total Sales by Half-Year

(1 USD = 1,384 KRW, exchange rate as of 26 July 2025)

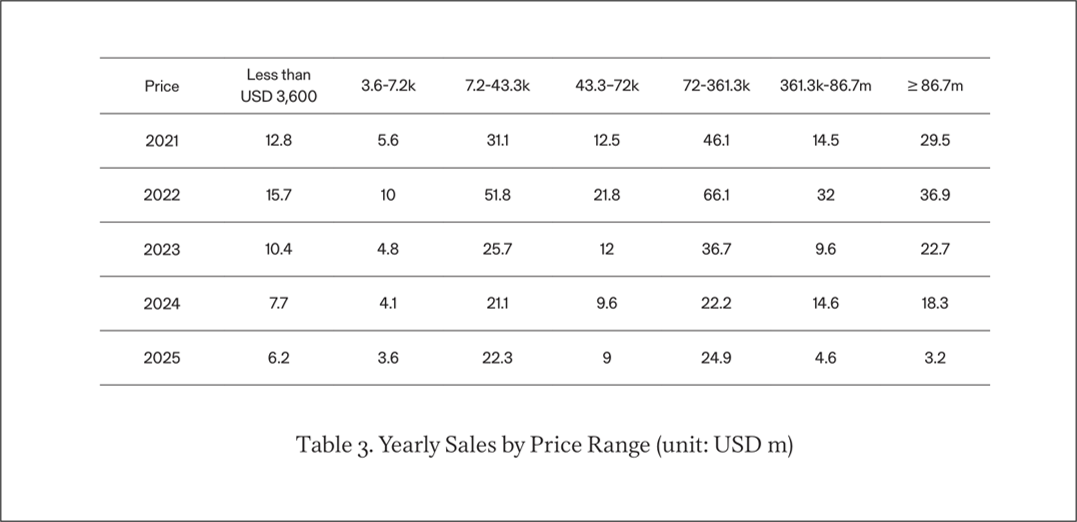

Yearly Sales by Price Range

What merits

careful attention is that high-end transactions over KRW 1 billion (≈ USD 720,000) have contracted sharply, while works in the KRW 100

million to 500 million range (≈ USD 72,000 –

360,000) have increased in share, showing a re-centering of the

market.

Data-analysis

team researcher Lee Su-bin interprets this as “as speculative demand that drove

the market’s upper tier disappears, a collector base oriented toward

medium-/long-term holding is returning.”

Also, according

to the report, the participation rate of MZ-generation collectors rose

from 18.4 % in 2023 to 24.1 % in 2025; these collectors prioritize “empathy”

over profit and “participation” over ownership.

Curator Jeong

Yu-jin states, “This generation is both fan and co-planner of the artist,” and “from

the point where the boundary between audience and artist dissolves, new demand

is emerging.”

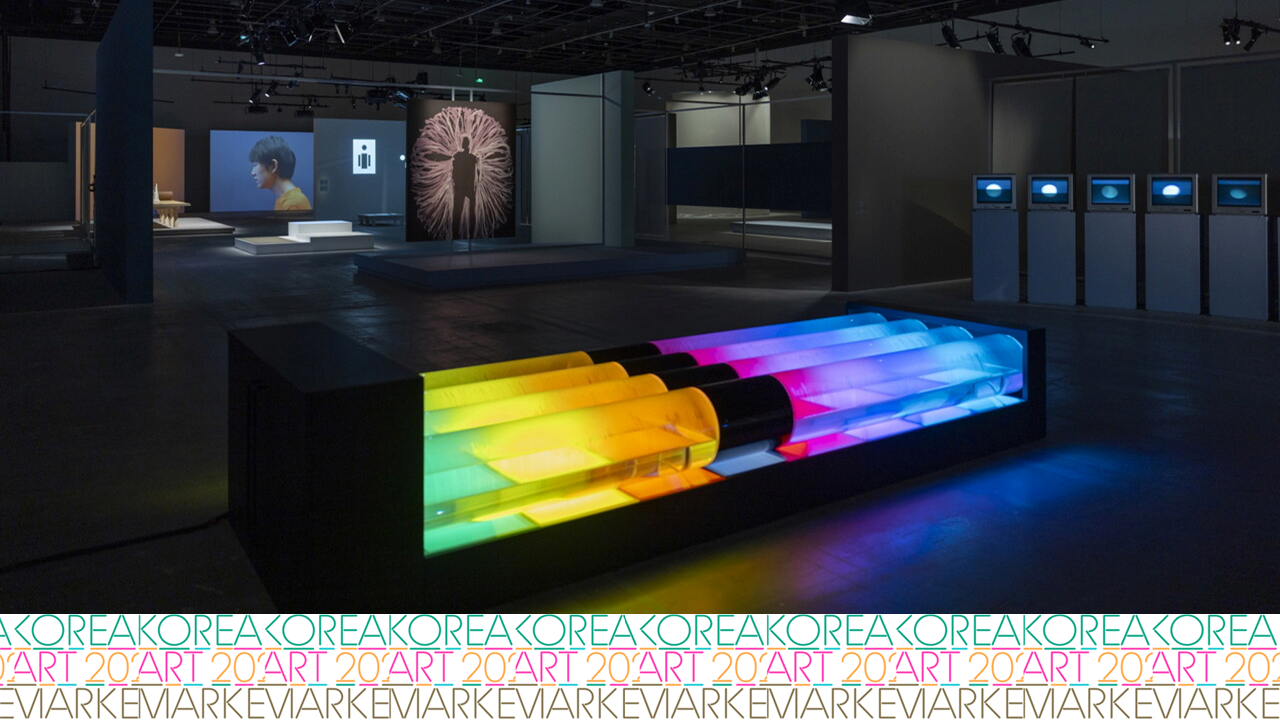

Exhibition View of the 2025 Galleries Art Fair / Photo: Galleries Association of Korea

Fair’s

comeback, expansion of the city

Another change in the Korean art market is visible in art fairs.

In 2025 the

Galleries Art Fair recorded 6,100 VIP day visitors, a 30 % increase year-on-year, and the sales share of emerging-artist

booths exceeded 40 %.

Researcher Hong

Ye-rin diagnoses, “Rather than only purchase-centred viewing, participatory

audiences consuming exhibitions as cultural experiences are increasing.” This

trend extends into Kiaf-Frieze Seoul and changes the urban spatial structure.

As one example,

in September 2025 the Frieze House Seoul modelled on London’s

‘No.9 Cork Street’, opened in Yaksu-dong.

Entrance to Frieze House Seoul, designed by Seoul-based architectural studio Samuso Hyoja, featuring a site-specific installation by Japanese architecture studio SANAA / Photo: Frieze official Website

Researcher Jeong

Seong-hun adds, “Seoul is expanding from a short-term sales-event city into a

network hub where art and industry coexist, and this change alters the

art-market performance indicators.”

In the past the

benchmark was “sales,” now “participation rate, dwell time, revisit

rate” are emerging as the new KPIs (Key Performance Indicators).

Research fellow Kim Min-seok forecasts, “The density of relationships is

becoming more important than market efficiency, and that point will determine

the sustainability of the Korean art market.”

From the

language of downturn to the language of transition

The conclusion of 《Korea Art Market 2025》 analyses that the 2025 Korean art market is not simply a slump but

a period of linguistic re-construction.

Galleries kept

their artists, collectors chose taste, cities transformed from places of sale

into places of relationship. In the final sentence of the report Kim Min-seok

writes: “The cold wave of 2025 is not the end of the market but the moment the

door to the next order opens.”

“Preference over

money, relationship over ownership, co-existence over generation” — this new

order is rewriting the future of the Korean art market.

Source (Download): Korea

Art Market 2025 (Seoul National University Business Research Institute

& Paradise Cultural Foundation, 2025).