The

Illusion of “Speculation” Disguised as Investment

Today’s

art market operates on a vast speculative structure camouflaged by the language

of “investment.” Artworks are no longer read as products of emotion or thought;

instead, they are interpreted as indicators of price volatility.

Galleries function with the logic of asset management firms, artists supply

brand value, and collectors behave like market analysts.

The

moment artworks are evaluated not for the pleasure of

possession but for their expected

financial return, the intrinsic interiority of art is

pushed further into the background.

“Once

art begins to speak in the language of the market, aesthetics becomes nothing

more than a shadow cast by numbers.”

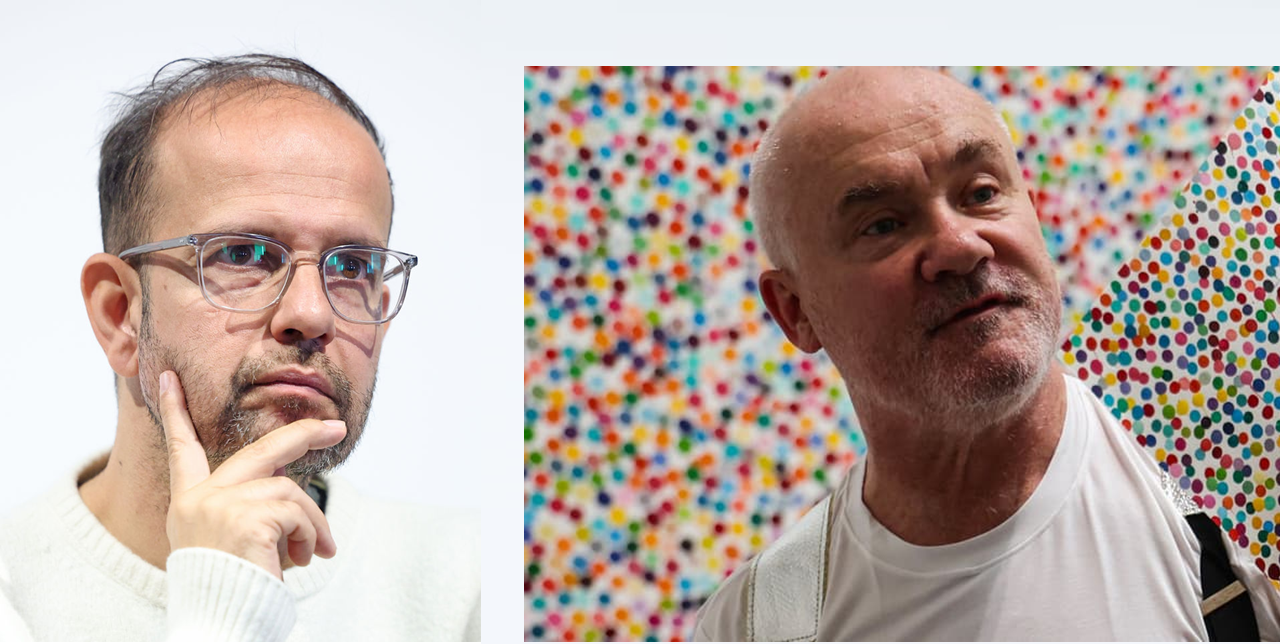

Steve

Cohen — A Financial Gaze Reshaping the Way Art Is Seen

Steve

Cohen, an American hedge fund manager, has long been known as a prominent

collector of contemporary art.

Steve Cohen / Photo: The New York Times

His

collecting approach often illustrates a tendency to interpret artworks not

primarily as emotional or aesthetic objects, but as assets that can be

understood through risk management and portfolio allocation.

Artist Jeff Koons poses for photographs with his work of art entitled Rabbit(1986)during the press view of the《Pop Life, Art In A Material World》exhibition at the Tate Modern, in London, on September 29, 2009. / Credit: BEN STANSALL/AFP/Getty Images

In

2019, when Jeff Koons’s Rabbit (1986) sold for

approximately $91 million at Christie’s,some media outlets reported that the

piece may have entered Cohen’s collection.

Although

this has not been officially confirmed, the event symbolized the degree to

which artworks are treated as high-value assets and how financial perspectives

increasingly shape the architecture of the art market.

Cohen’s

perspective represents an expansion of financial language

into the cultural sphere—a shift that has become a key lens through which the

contemporary art market now operates.

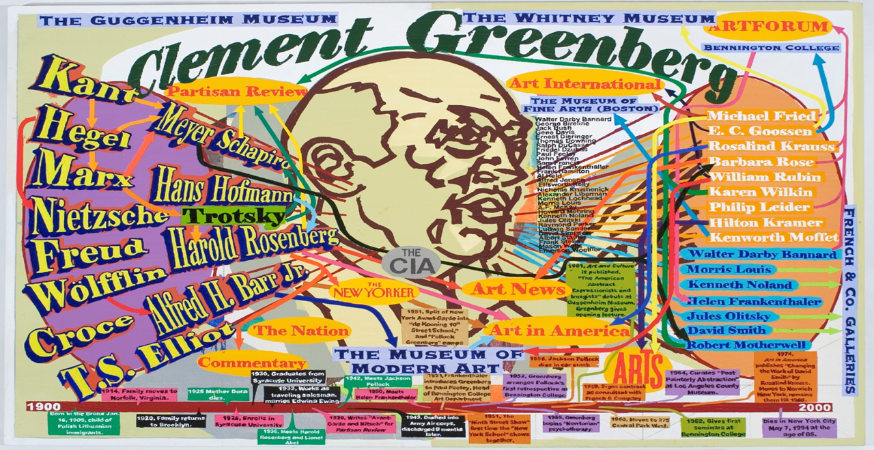

Charles

Saatchi — The Power of Curating Art Into a Cultural Phenomenon

Charles

Saatchi, the advertising magnate turned collector, played a pivotal

role in the rise of the “Young British Artists (YBAs)” movement in the 1990s.

Charles Saatschi / Photo: Google

He

actively supported emerging artists such as Damien Hirst, Tracey Emin, and

Sarah Lucas, helping their works expand into broader cultural and popular

phenomena.

Saatchi’s

strategic curatorial choices and media acumen demonstrated how art could be

consumed not simply as creative expression but as a cultural brand

and a market phenomenon.

He

was both a patron and a director who shaped the market-oriented structure of

the art ecosystem—revealing how art could be transformed into a curatable

commodity.

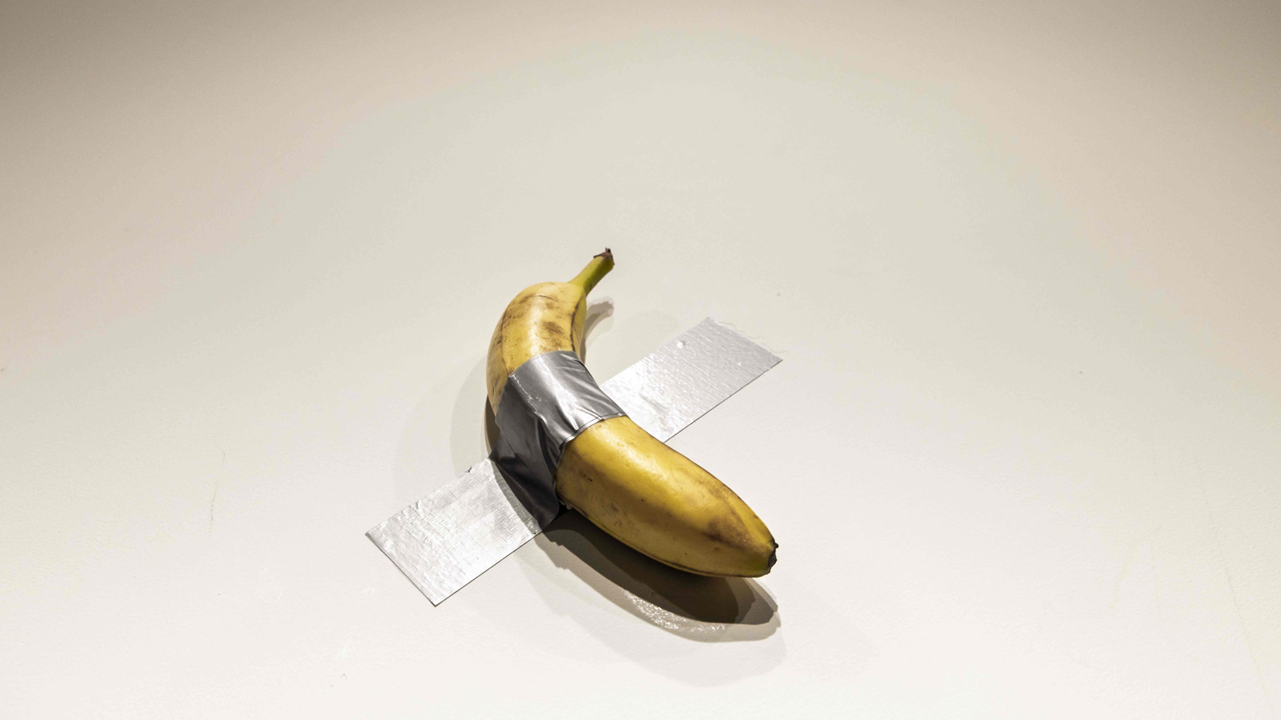

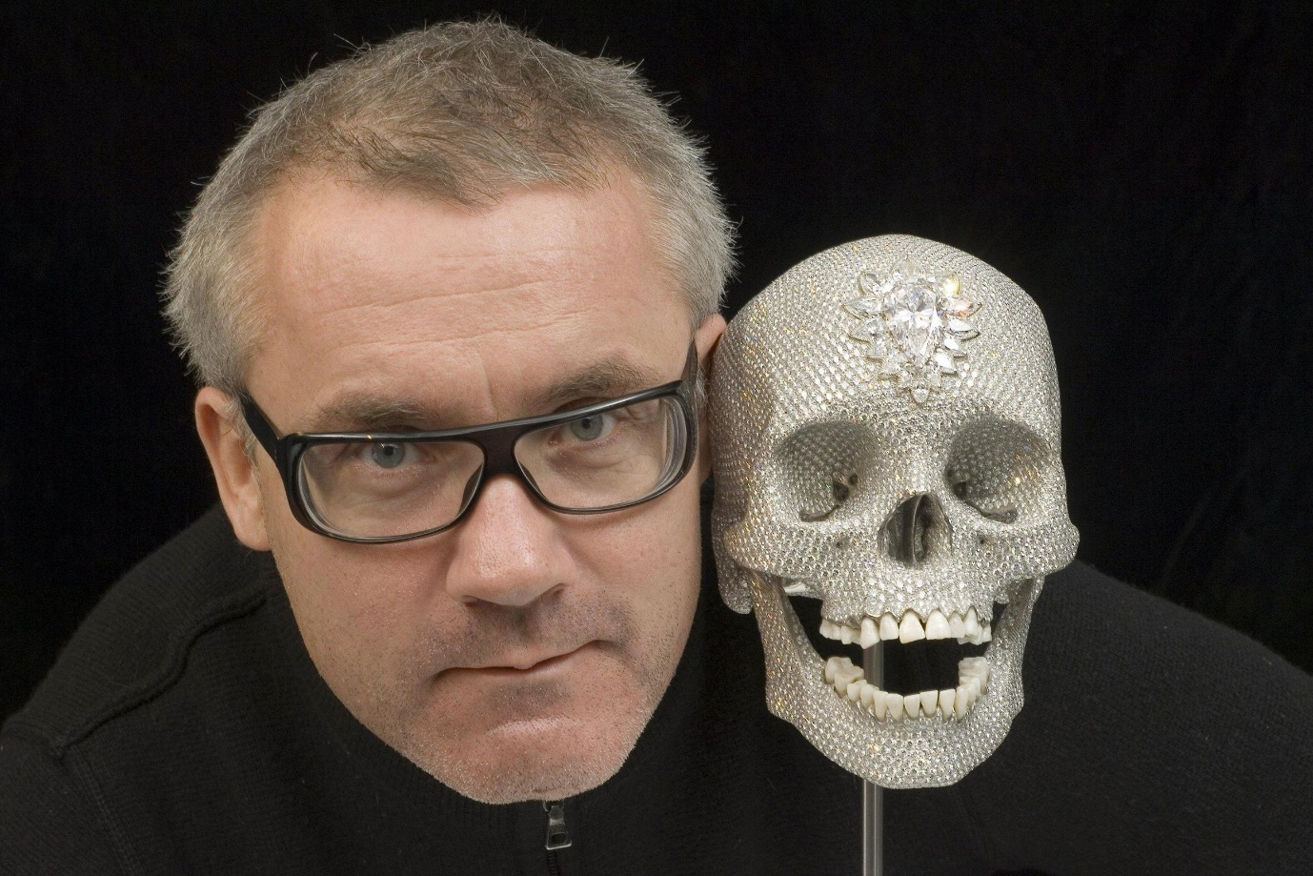

Damien

Hirst — Between Creation and Market Strategy

Damien

Hirst has been one of the most influential figures in the global art market

since the 1990s.

Damien Hirst / Photo: The Times

Damien Hirst poses with his work The Incredible Journey at Sotheby’s art gallery and auction house in London, 2008. / Photo by Shuan Curry/AFP/Getty Images.

Auction of work by Damien Hirst at the Sotheby’s sale “Beautiful Inside My Head Forever,” 2008. / Courtesy of Sotheby’s.

This

unprecedented move marked one of the first large-scale attempts by an artist to

construct the market himself by stepping outside traditional distribution

structures.

Hirst’s

practice reveals how artistic innovation and market strategy can intertwine. He

became both an artist and a brand operator—a figure emblematic of the

dual structure of contemporary art, where creation and

commodification unfold in parallel.

Art

Investment — The Zero-Sum Structure Created by the Marketization of Art

While

the art market is often portrayed as a landscape where “Everyone Wins,” in

reality, it functions within a structure shaped by scarcity and competition.

A

small number of artists and works experience dramatic price increases, while

countless others remain unseen and unknown. As

prices rise, criticism and discourse recede; aesthetic value increasingly takes

a back seat to market attention.

“Art

no longer interprets the world. It merely reflects the world’s price tags.”

This

shift signifies art’s movement away from the language of emotion and thought toward the language of investor psychology and market expectation.

Art

and Capital — A Relationship of Symbiosis and Parasitism

Capital

can expand the reach of art, but it can also transform and weaken its core

language. As demand grows, artistic expression tends to simplify; scarcity

becomes a metric of return; authenticity is reinterpreted as market trust.

The

relationship between art and capital is undeniably symbiotic—yet this symbiosis

can mutate into a parasitic structure at any moment.

When art begins to reshape itself according to capital’s criteria, its inner

language gradually disappears.

Returning

from “How Much” to “Why”

The

term “art investment” may be nothing more than a rhetorical frame created by

capital to legitimate its own presence. For

art to sustain its original vitality, we must return from “how much

an artwork is worth” to “why the artwork exists.”

Only

when this question is restored can art step out of the market’s game board and

once again speak in the language of human perception and thought. The

true value of art lies not in price but in the depth of reflection; not in

marketability but in the necessity of expression.

And

this depth remains a domain of human sensibility—one that capital can never

truly possess.

Jay Jongho Kim graduated from the Department of Art Theory at Hongik University and earned his master's degree in Art Planning from the same university. From 1996 to 2006, he worked as a curator at Gallery Seomi, planning director at CAIS Gallery, head of the curatorial research team at Art Center Nabi, director at Gallery Hyundai, and curator at Gana New York. From 2008 to 2017, he served as the executive director of Doosan Gallery Seoul & New York and Doosan Residency New York, introducing Korean contemporary artists to the local scene in New York. After returning to Korea in 2017, he worked as an art consultant, conducting art education, collection consulting, and various art projects. In 2021, he founded A Project Company and is currently running the platforms K-ARTNOW.COM and K-ARTIST.COM, which aim to promote Korean contemporary art on the global stage.