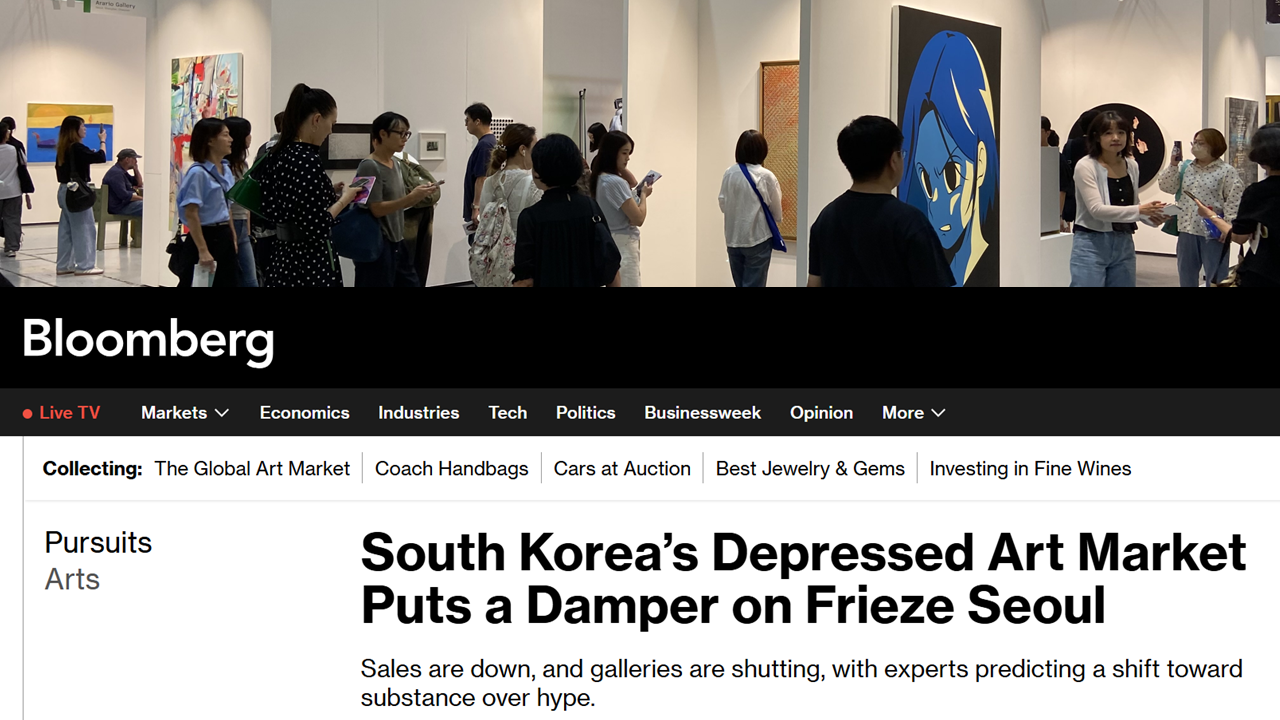

The results of

this year’s Kiaf and Frieze Art Fair show that Korea has not yet proven itself

as the hub of the Asian art market. Nevertheless, the tangible sales achieved

by young artists and the steady performance of mid-sized Korean galleries

revealed that the Korean market is no longer merely a site of consumption.

Instead, it is increasingly showing potential to become a market where both

production and distribution operate together.

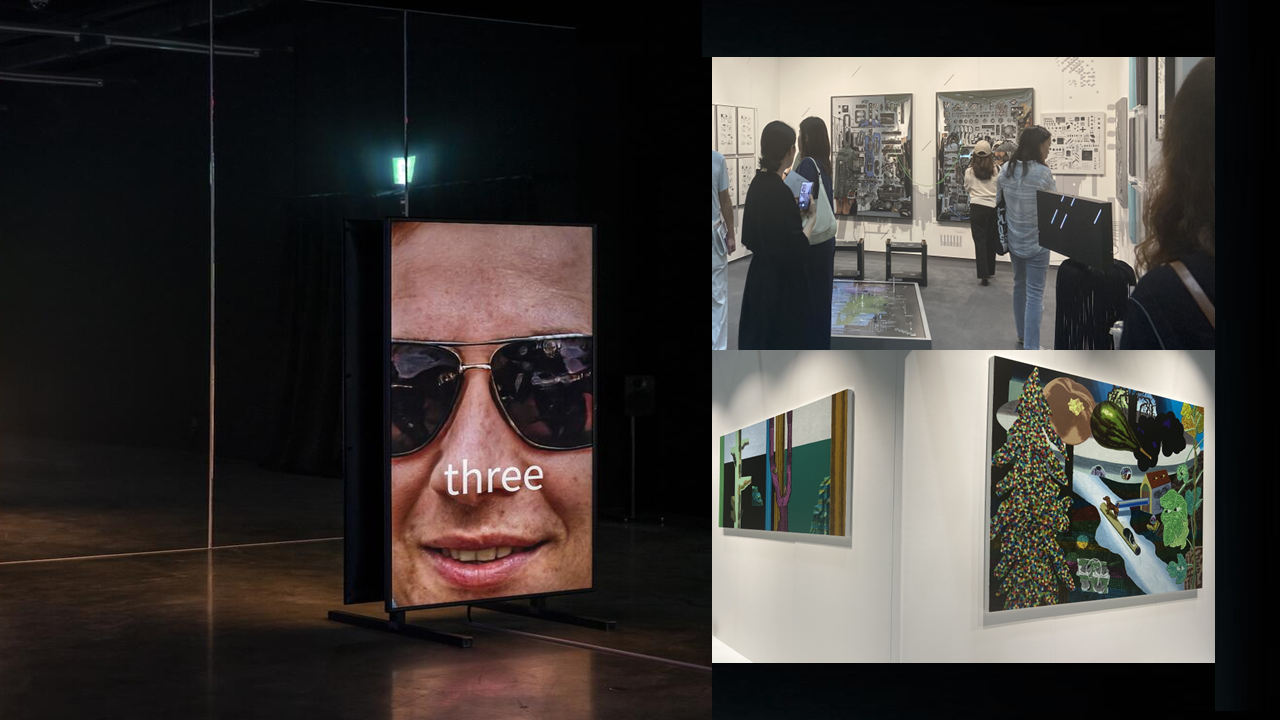

The winner of the 2025 Focus Asia Stand Prize, Kohesi Initiatives. Photo: Wecap Studio. Courtesy of Frieze.

Through an

international-level fair such as Frieze, the Korean art market has expanded its

scope. If the experiences accumulated over four editions of Frieze Seoul can be

actively utilized, it is clear that Korea not only has the potential to become

the center of the Asian art market through systematic market management, but

also the capacity to project itself onto the global stage.

Young artists’

achievements signal new vitality in the market

One of the most

notable changes at Frieze Seoul was the active sales of works by young artists.

Mire Lee sold a work at Sprüth Magers for around 48 million KRW (≈ $36,000), drawing attention on the international stage. Heemin

Chung sold a painting at Thaddaeus Ropac for about 30 million KRW (≈ $22,000), while Suki Seokyeong Kang’s

sculpture sold at Tina Kim Gallery for approximately 20 million KRW (≈ $17,000), raising her profile among overseas collectors.

Mire Lee. / Photo: Jihyun Kim

Installation view of 《Hyundai Commission: Mire Lee, Open Wound》(2024) at Tate Modern’s Turbine Hall.

ThisWeekendRoom,

a young gallery, also attracted notice. Jinhee Kim’s paintings sold for between

the high 20 million to low 30 million KRW range (≈ $22,000–$24,000), while Jiwon Choi and

Seoul Kim each sold works in the high 20 million KRW range (≈ $22,000).

ThisWeekendRoom, Frieze Seoul 2025. Photo: Wecap Studio. Courtesy of Frieze.

View of the emerging gallery ThisWeekendRoom / Photo: Harper’s Bazaar.

Artist Jiwon Choi in front of her representative work Frozen Moment(2023) / Photo: ThisWeekendRoom.

These

transactions confirmed that demand in the market is not confined to Dansaekhwa

masters or modern artists. Works by younger generations, currently active in

the field, are also meeting substantial demand. Particularly, sales in the

$20,000–$50,000 range play an important role as an

entry point for new collectors.

View of Jason Haam Gallery’s booth, actively participating in recent domestic and international art fairs.

The steady

performance of mid-sized galleries demonstrates self-sustaining growth

Mid-sized Korean

galleries also showed solid results. Hakgojae sold a 1960s work by Kim Whanki

for about 2 billion KRW (≈ $1.45 million),

while also selling a painting by Song Hyun-Sook in the 100 million KRW range (≈ $75,000), thereby demonstrating its capacity to span both modern

and contemporary artists. Kukje Gallery sold a painting by Ha Chong-Hyun for

more than 200 million KRW (≈ $145,000), a

work by Kibong Rhee in the 100 million KRW range (≈ $75,000), an embroidery piece by Kyungah Ham in the 50 million KRW

range (≈ $36,000), and a

painting by Kim Yun Shin around 30 million KRW (≈ $22,000).

View of Kukje Gallery’s booth at Frieze Seoul 2025.

View of Jeon Hyunsun’s work on display at Galerie Lelong’s booth at Frieze Seoul 2025.

Tina Kim Gallery

reported sales including a painting by Ha Chong-Hyun in the high 300 million

KRW range (≈ $275,000) and a

painting by Kang Seokho for around 60 million KRW (≈ $44,000). These results show that Korean mid-sized galleries are

capable of attracting international collectors through their own brands and

rosters of artists, without relying solely on mega-galleries. This provides

important evidence of the self-sustaining growth potential of the Korean art

market.

View of Pibi Gallery’s booth featuring major mid-career Korean artists.

The limits of

a repetitive blue-chip strategy

Nonetheless, the

market’s limitations remain. Many galleries have for years repeated exhibitions

centered on the same blue-chip artists, focusing on stable sales. While such

strategies may be effective in generating short-term revenue, they restrict the

inflow of new collectors and hinder market expansion.

The reason young

galleries have gained attention in recent years lies precisely here. They

discovered new artists and introduced works that reflected a contemporary

sensibility. The active transactions at young galleries’ booths at Frieze Seoul

reaffirmed that new names and new attempts are the most crucial factors in

driving market growth.

Structural

changes required for market specialization and systematization

For the Korean

art market to grow further, it needs to go beyond mere expansion and pursue specialization

and systematization.

First, the

criteria for selecting galleries at art fairs must be strengthened. Beyond

simple sales records, curatorial capacity to discover young artists and present

contemporary relevance should be reflected as a key requirement. This would

make portfolios that balance “half stability and half experimentation”

possible.

Second,

transparency in transaction data is essential. Once again, Kiaf and Frieze did

not release full sales results, with only selected highlights shared through

press channels. Going forward, sales data from international art fairs such as

Frieze Seoul should be standardized and archived, to be used for market

analysis and policy development. The current closed and opaque structure

undermines trust in the market and discourages the participation of

international collectors and institutions.

Third, the

collector base must be broadened. Mechanisms should be in place to facilitate

first purchases, particularly for works priced in the $20,000–$50,000 range.

Entry-level education and tour programs, artwork storage and insurance guides,

and tax incentive information could be provided. Such measures would help build

not just one-time buyers but sustainable collector communities.

Fourth,

supportive policies and systems must follow. Tax benefits for art donations,

inheritance tax relief, and public art leasing systems would stimulate the

circulation of high-value works. Practical measures such as easing overseas

export and import procedures and supporting international shipping are also

needed.

Finally, stronger

links with the secondary market are important. For price formation to stabilize

and artist career management to be effective, the auction market and the

primary market (galleries, fairs) must be organically connected.

Strategic

tasks for entry into the global market

For the Korean

art market to be recognized globally, it must move beyond merely “exporting”

works and function as a producer of international discourse. This

requires joint exhibitions and co-production projects with overseas

institutions. Galleries and institutions should actively collaborate with

global networks to integrate Korean artists into international debates.

In addition,

partnerships with global corporations and collaborations with international

foundations can demonstrate that Korean art is not just a consumer product but

a creative partner. The collaborative exhibitions and projects staged

alongside Frieze Seoul highlighted this potential. Moving forward, these

efforts must become institutionalized rather than remain one-off events.

Conclusion:

New attempts will decide the future of the Korean art market

Frieze Seoul

showcased both the current state of the Korean art market and its challenges.

Young artists’ sales confirmed the vitality of the market, while the steady

performance of mid-sized galleries proved the possibility of self-sustaining

growth. At the same time, the repetitive blue-chip focus exposed clear

limitations, underlining the urgent need for market systematization and

specialization.

What is required

now is transparent data, the discovery of new artists, expansion of the

collector base, and policy support. Above all, it is crucial to create a

structure in which new attempts are rewarded. Only then will the Korean art

market go beyond a merely expanded stage and establish itself as a credible

hub of production and distribution in the global contemporary art scene.