Cover image of the “Annual Art Market Report 2022” published by the Korea Art Authentication Appraisal Inc. (KAAAI).

Cover image of the “Annual Art Market Report 2022” published by the Korea Art Authentication Appraisal Inc. (KAAAI).The year 2022 was a busy one for the Korean art market, with numerous predictions and expectations. On January 18, the Korea Art Authentication Appraisal Inc. (KAAAI) published the Annual Art Market Report 2022 to analyze and summarize the Korean and international art markets of 2022 and provide a forecast for the current year.

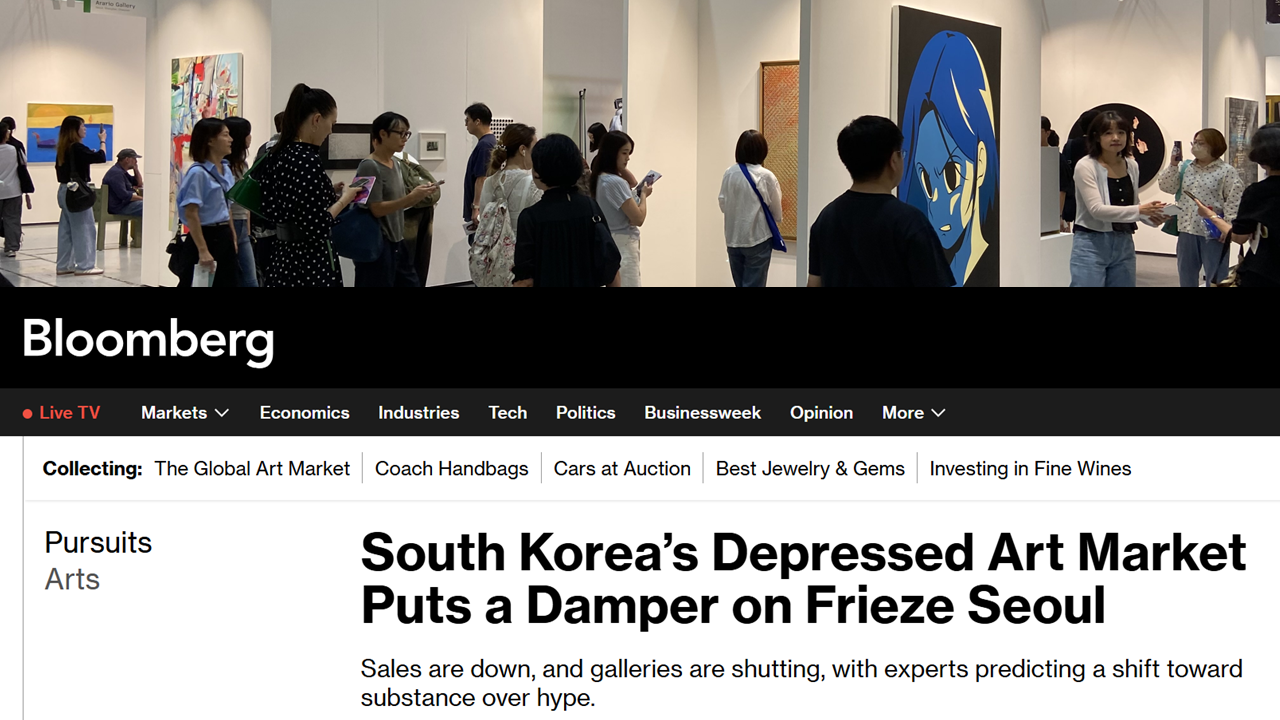

With the opening of Frieze Seoul, the Korean art market grew rapidly, with numerous young artists and collectors entering the market. However, unlike previous years, this year may not be as promising for ultra-contemporary artists.

According to the report, until the first half of last year, the auction market for young artists grew rapidly, but in the second half, their sales declined.

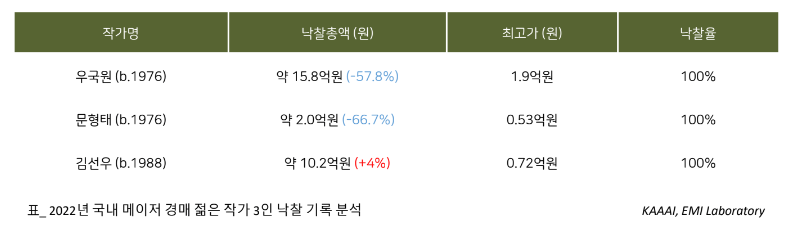

Woo Kuk Won, Moon Hyeong-tae, and Kim Sunwoo were the three young artists whose names appeared the most in Korean auction houses. The works of these three artists all showed a 100% sales rate in 2022, but the total amount of sales fell or barely maintained the previous year’s record.

The total sales amount of Woo’s artworks was 1.58 billion KRW (Korean won, approximately $1.28 million) in 2022, a 57.8% decline from the previous year, and Moon’s artworks totaled 200 million KRW, a 66.7% decline. Kim’s total sales for the year were slightly higher than the previous year’s record, increasing by 4% to 1.02 billion KRW.

Data from KAAAI and EMI Laboratory, 'Top 3 Young Korean Artists at Major Korean Auctions in 2022,' "Annaul Art Market Report 2022." Reproduced by permission of the KAAAI.

Data from KAAAI and EMI Laboratory, 'Top 3 Young Korean Artists at Major Korean Auctions in 2022,' "Annaul Art Market Report 2022." Reproduced by permission of the KAAAI.The report pointed out that the average survival period for these ultra-contemporary artists in the Korean auction market is only about six months, indicating that the Korean art market is still unstable and collectors are still influenced by word-of-mouth rather than objective information.

However, signs of stagnation are not just the case for South Korea. The contemporary art market, especially ultra-contemporary art, has been declining worldwide. Total global contemporary auction sales decreased by 15.8% in 2022 compared to 2021, and ultra-contemporary art market sales decreased by 22.9% from $395.8 million in 2021 to $305.3 million in 2022, according to the report.

Kiaf SEOUL 2021. Photo by Kiaf SEOUL operating committee. Courtesy of Kiaf SEOUL.

Kiaf SEOUL 2021. Photo by Kiaf SEOUL operating committee. Courtesy of Kiaf SEOUL.The most important thing the Korean art market must note is that the reliability of works by emerging artists in Asia has declined. From 2019 to 2021, sales of works by emerging artists in Hong Kong accounted for 32.1% but fell to $63.8 million from $142.3 million in 2021. New York had 45.1%, while London had 22.6%.

In an interview with reporter Jang Jae-seon of the Munhwa Ilbo, Yeechun Son, the public relations director and principal auctioneer at K Auction, said, “This is also the case in overseas markets, but the price drop is greater in the Korean auction market because of the high risk and low reliability of young and emerging Korean artists.” “The same happened in 2006 and 2007,” he added, “and collectors who experienced a similar situation 15 years ago are making more conservative purchases even during this boom.”

Just as Son mentioned, the report also predicted that Korean collectors would tend to make more stable and conservative art investments in 2023 and expected that there would be an increase in indirect investments, such as art funds, art trusts, and fractional investments, rather than direct purchases in galleries, art fairs, or auction houses.

Kiaf SEOUL 2019. Photo by Kiaf SEOUL operating committee. Courtesy of Kiaf SEOUL.

Kiaf SEOUL 2019. Photo by Kiaf SEOUL operating committee. Courtesy of Kiaf SEOUL.The report emphasized that the more this investment trend increases, the more reliable price information and the authenticity of the information are needed.

Millennials born between the early 1980s and early 2000s will lead the art market in the future. Like the older generation, this generation collects works for their aesthetic value but also places a significant emphasis on investment. In a market where buyers view art as a complete investment, it is even more critical to have a professional system with objective and transparent information.

As reported by the Artprice report in June 2022, contemporary art auction sales in Korea increased by 344%, and the global expectations for the Korean art market are no longer mere speculation. Especially since the inaugural Frieze Seoul was held last year, the overseas market views the Korean art market as something worth looking forward to, although they will continue to monitor the situation’s development for some time.

Frieze Seoul 2022, COEX, Seoul. Photo by Aproject Company.

Frieze Seoul 2022, COEX, Seoul. Photo by Aproject Company.The outlook remains optimistic, but the report noted that Frieze and overseas galleries in the country, as well as local collectors, are relatively indifferent to Korean artists, with a few notable exceptions, including Kim Whanki and Lee Bae. The report emphasized that in order for the Korean art market to be competitive in the international market, local artists must be supported on a global scale.