TogetherArt,

a platform for issuing art investment contract securities, is South Korea’s

first comprehensive art trading platform, offering fractional art investment

services starting from 10,000 KRW. This allows the general public to own shares

in artworks through small-scale investments.

Since

launching the 'ArtTogether' service in 2018, the platform has introduced over

100 works by world-renowned artists such as Picasso, Andy Warhol, and Yayoi

Kusama, as well as celebrated Korean artists like Lee Ufan. Beginning with the

issuance of its first art investment contract security in January 2024,

TogetherArt completed six issuances by the end of the same year, making it the

issuer with the highest number of securities in the market.

The

subscription results of the two most recent securities issued by TogetherArt

clearly reflect the current state of the Korean art market. The securities,

backed by Lee Ufan’s Dialogue

and Nicolas Party’s Landscape,

recorded subscription rates of 53.82% and 40.72% respectively, falling short of

expectations. These results suggest complex issues that go beyond simple market

downturns or external factors.

Lee Ufan's Dialogue: The

Balance Between Trust and Value

The issuance of securities based on Lee Ufan’s Dialogue

marked the first time TogetherArt used a piece purchased directly from an

individual for 880 million KRW as the underlying asset. Created in 2011, this

large-scale work (size 150) exemplifies the fusion of Eastern philosophy and

Western minimalism.

Lee Ufan's Dialogue (2011), used as the basis for TogetherArt’s 7th issuance. © TogetherArt

Despite

securing authentication from the two major appraisal institutions in Korea to

validate the artwork's authenticity, the subscription rate only reached 53.82%,

falling short of expectations. The unsold portion, worth approximately 490

million KRW, was directly absorbed by the company.

This

outcome can be attributed to the perception that this particular piece is not

considered a major work by Lee Ufan, coupled with recent forgery controversies

surrounding his works, which have significantly impacted market trust.

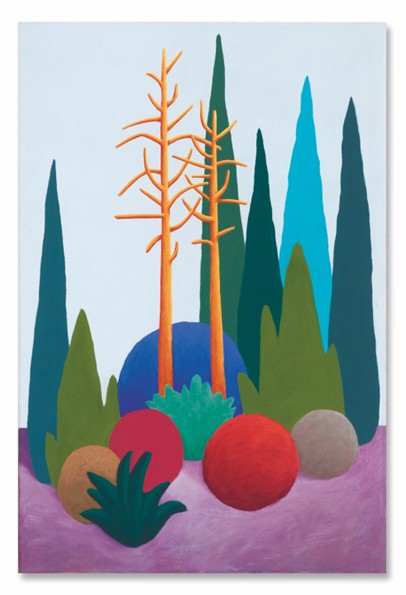

Nicolas Party's Landscape: The

Impact of External Factors and the Burden of High-Value Assets

The issuance of securities backed by Nicolas Party’s Landscape,

valued at 2.3 billion KRW, garnered attention as the largest art investment

contract security issued in Korea. TogetherArt acquired this piece from

Christie’s for 2.1 billion KRW, with the total issuance price set at 2.3

billion KRW, including operational costs.

Nicolas Party, Landscape (2014) © TogetherArt

However,

the subscription rate remained at 40.72%, with TogetherArt absorbing the unsold

portion of approximately 1.5 billion KRW. The subscription period began on

December 5, just two days after the declaration of martial law, which

heightened instability in the financial markets and subsequently affected the

art market. The total funds raised from general investors amounted to about 800

million KRW, even less than the 1 billion KRW raised during the previous Lee

Ufan issuance.

Future Strategies for the Korean Art

Market: Understanding the Correlation Between Investment and Value

These results illustrate that the Korean art investment market is driven by

more than just financial considerations. Factors such as the art historical

value of works, market trust, and external economic conditions interact to

influence investment outcomes.

Despite

TogetherArt’s efforts to ensure the authenticity and credibility of the

artworks, investors remain cautious, reflecting the complexities of the market.

For

platforms like TogetherArt, as well as auctions and galleries, to achieve

sustainable growth, they must go beyond relying solely on the fame or

marketability of artists. Instead, they should deeply understand the art

historical context and intrinsic value of artworks and effectively communicate

this to investors.

Furthermore,

to restore trust in the art investment market, transparent information sharing

and the inclusion of a more diverse range of artists and works in portfolios

should be considered to broaden the market’s scope.

Importantly,

evaluating artworks from a long-term perspective and building trust with

investors is crucial. This process will play a vital role in strengthening the

connection between the Korean art market and the global scene, laying the

foundation for sustainable growth.

Outlook for the Korean Art Market in 2025

In 2025, the Korean art market faces dual challenges: unstable external

conditions and internal trust issues. However, these challenges also present

new opportunities. By enhancing transparency and trust in the art investment

market, discovering diverse artistic values, and expanding the market, the

Korean art scene can secure a significant position in the global market.

TogetherArt’s

case serves as an important indicator of these potential shifts and will be a

valuable reference point in determining the future direction of the Korean art

market.