The

Korean art auction market in 2024 faced its most challenging period in the past

five years, reflecting a significant downturn. The annual auction turnover

reached approximately 115.1 billion KRW (around 87.2 million USD), comparable

to the recessionary period of 2020.

This

figure represents only 75% of the turnover in 2023 (153.5 billion KRW, around

116.3 million USD) and about 35% of the peak in 2021 (329.4 billion KRW, around

249.3 million USD), highlighting the market's contraction. The auction success

rate also dropped to 46.4%, marking the lowest point in five years, compared to

51.2% in 2023 and 67.47% in 2021.

Both

the number of works consigned and those sold decreased across the board. This

year, a total of 22,934 works were consigned, down from 27,814 in 2023, with

10,641 works sold, compared to 14,238 in the previous year. The market, which

in 2023 focused on traditional Korean art such as Joseon-era porcelain,

returned to contemporary art dominated by Dansaekhwa, reflecting a shift back

to stable investment sentiment.

Key

Artists’ Performance

In terms of total auction turnover by

artist, Kim Whanki regained the top spot with approximately 7.37 billion KRW

(around 5.6 million USD). However, this is only about half of the 13.47 billion

KRW (around 10.2 million USD) recorded by the previous year’s leader, Lee Ufan,

underscoring the market's decline.

Kim Whanki's 〈3-Ⅴ-71 #203〉 garnered significant attention in the market this year, achieving the highest single artwork auction price of approximately 5 billion KRW (around 3.8 million USD).

Kim Whanki’s 〈3-Ⅴ-71 #203〉 achieved the highest single auction price of the year, selling for approximately 5 billion KRW (around 3.8 million USD), drawing significant attention. Lee Ufan maintained his popularity with steady demand across his series, while Lee Bae ranked third, with his ‘Brushstrokes’ series particularly well-received in the market.

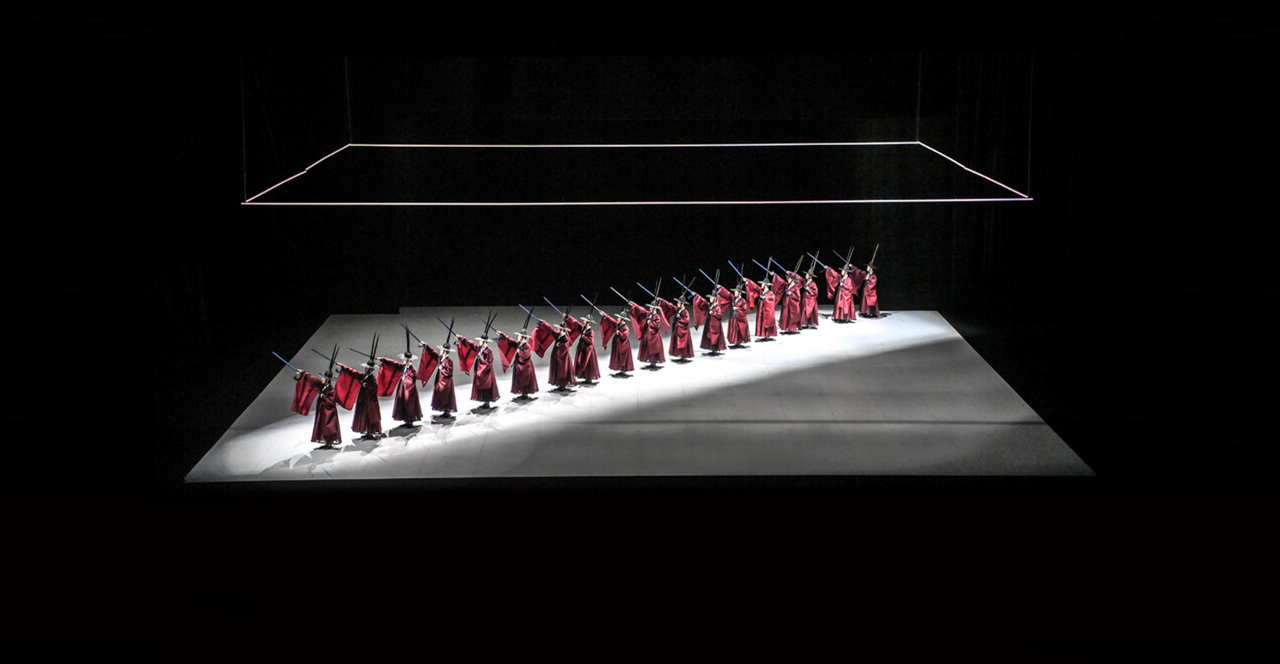

Auction

Houses’ Performance and Characteristics

Seoul

Auction led the market with a total auction turnover of approximately 48.1

billion KRW (around 36.4 million USD), narrowly surpassing K Auction at 43.6

billion KRW (around 33 million USD). Seoul Auction also achieved a higher

average success rate of 49.5%, compared to K Auction’s 42.7%. Together, these

two major auction houses accounted for about 80% of the market share,

reflecting increased reliance on large auction houses during economic

downturns.

Unsold

Blue-Chip Artworks

Even

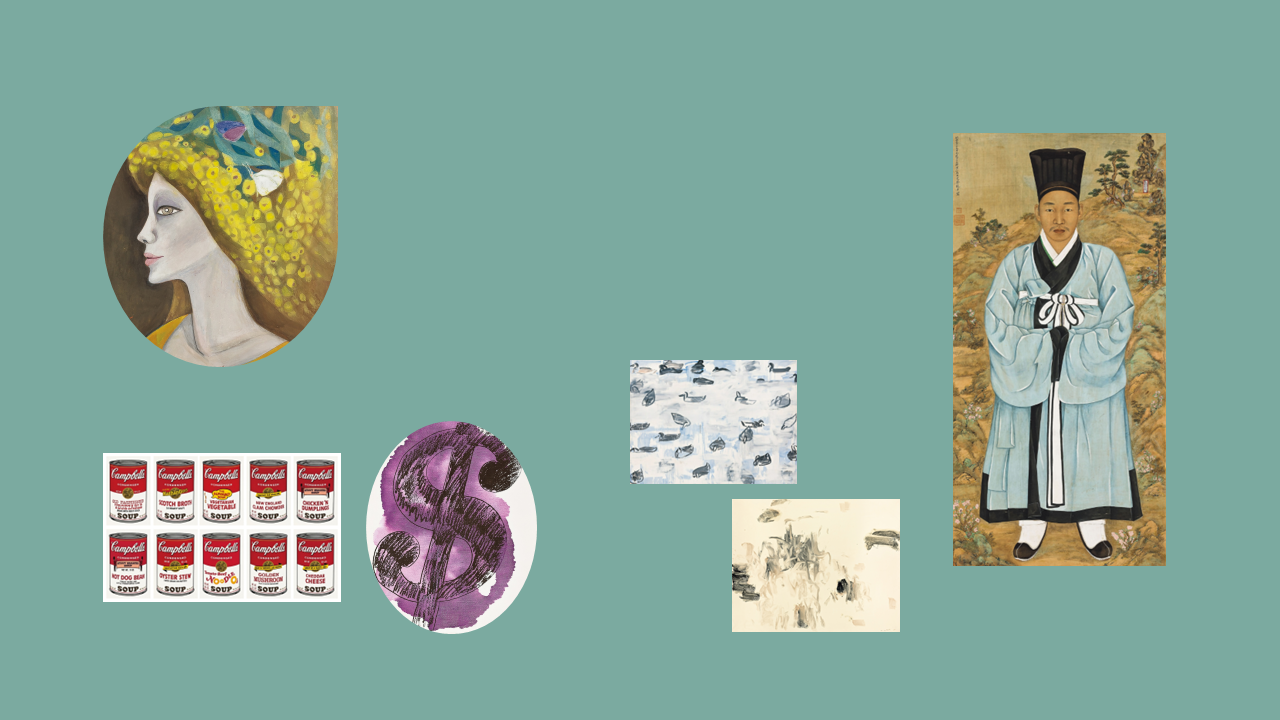

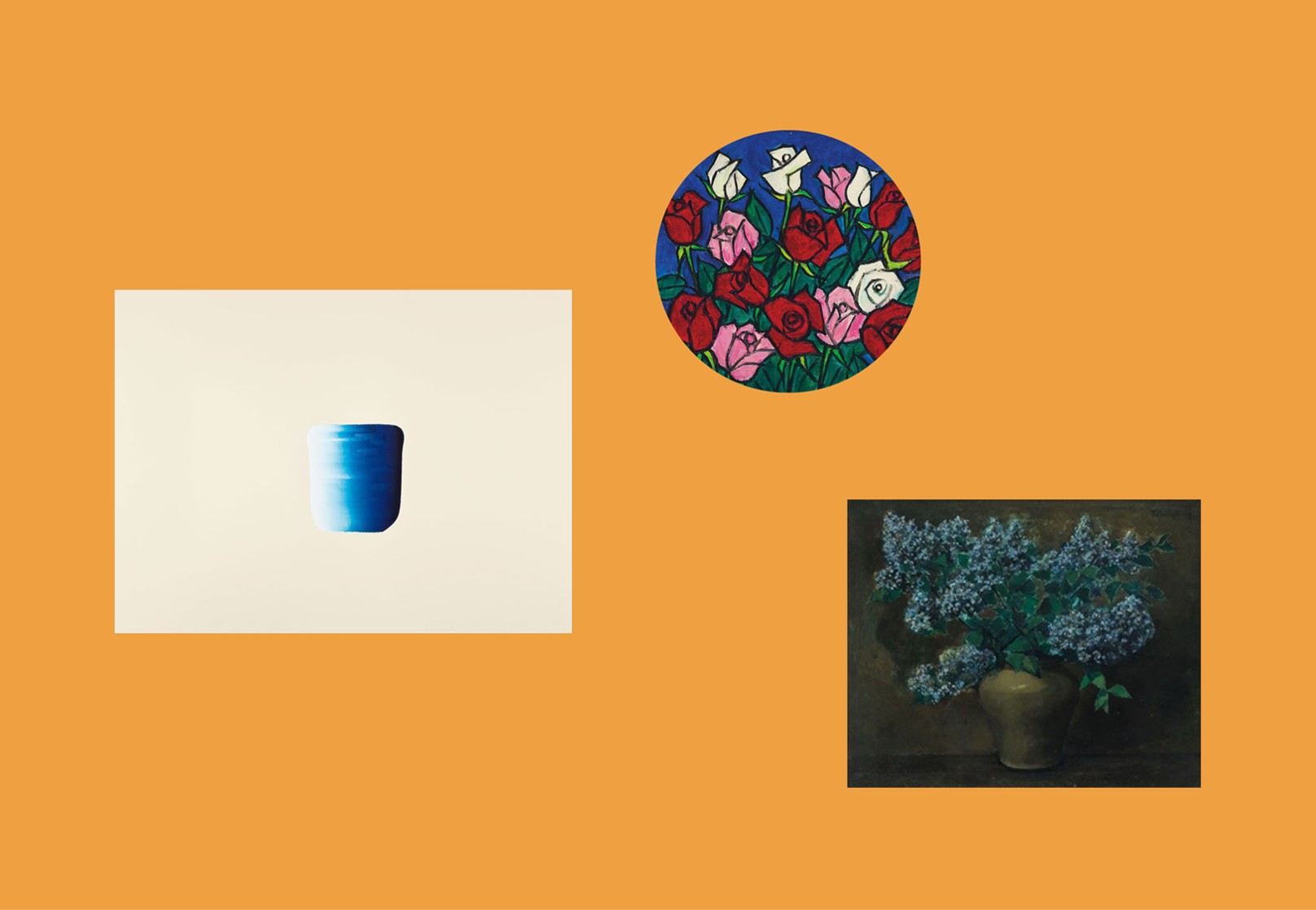

blue-chip artists’ works were not immune to the downturn. Notably, Kim Whanki’s

1958 work 〈Hanggari〉 (estimated at 950 million–1.5

billion KRW, or approximately 720,000–1.13 million USD) failed to sell at K

Auction’s major auction in October. This piece, celebrated for its lyrical

depiction of Korean beauty through motifs like a blue full moon and white

porcelain, failed to find a buyer.

Kim Whanki's 〈Hanggari〉 (1958), 50×60.6 cm. [Photo courtesy of K Auction]

Similarly, Lee Ufan’s 1995 work 〈Dialogue〉 (estimated at 280–500 million KRW, or approximately 213,000–380,000 USD) was unsold at Seoul Auction’s live auction the same month, highlighting the market's overall stagnation.

Artworks

Sold Below Expectations

Among

the works that did sell, many went for lower-than-expected prices. Lee Bae’s 〈From Fire

M12〉 (2003), a 100-ho canvas work, was auctioned at K

Auction in November.

Lee Bae, 〈From Fire M12〉, 2023, charcoal on canvas, 160 x 130 cm / © K Auction

With only one bidder participating, it sold for its starting price of 300 million KRW (around 230,000 USD), demonstrating significantly reduced competition in the market.

Withdrawn

High-Value Artworks

Several

high-value works were withdrawn from auction, reflecting market uncertainties.

For instance, Kim Whanki’s 〈18-II-72 #221〉 (1972), estimated at 2.4–4 billion KRW

(approximately 1.8–3 million USD), was scheduled for Seoul Auction in November

but was withdrawn by the consignor just before the auction.

Kim Whanki, 〈18-II-72 #221〉, 1972, oil on cotton, 48.1 × 145.3 cm / © Seoul Auction

This suggests growing hesitation among sellers due to market unpredictability.

Changes

in Genre Distribution

In

terms of genre, paintings and prints continued to dominate, accounting for

about 80% of the market. Drawings and calligraphy saw slight increases, rising

to 5% and 4%, respectively. While this indicates some diversification, the

market remains heavily reliant on flat art genres.

Market

Concentration and Need for Improvement

The

market continues to exhibit high dependence on a few key artists, such as Kim

Whanki and Lee Ufan. According to the KYS Art Price Index, Kim Whanki’s

per-unit price index was set at 100, with Lee Ufan at 75.07 and Lee Bae at

6.11, reflecting a significant disparity. These highlights limited diversity in

the market and concentrated investment sentiment.

Outlook

and Recommendations

The

Korean Art Price Appraisal Association attributes the art market’s stagnation

to the broader economic slowdown. With little optimism for recovery through the

next year, the association has called for public institutions and corporations

to encourage art consumption. Additionally, government support policies are

deemed critical. Strengthening the art industry’s competitiveness will require

fundamental and collaborative solutions to adapt to the evolving market

environment.

As

2024 draws to a close, the Korean art auction market ends the year in

unprecedented stagnation. Moving forward, rebuilding trust and adopting new

approaches tailored to the changing market landscape will be essential for

recovery.