Compared to 2019, the global art sales decreased by 22% in 2020, but online sales doubled to an all-time record of $12.4 billion, according to Art Basel and UBS’s The Art Market 2021 report.

Photo by Zach Key on Unsplash

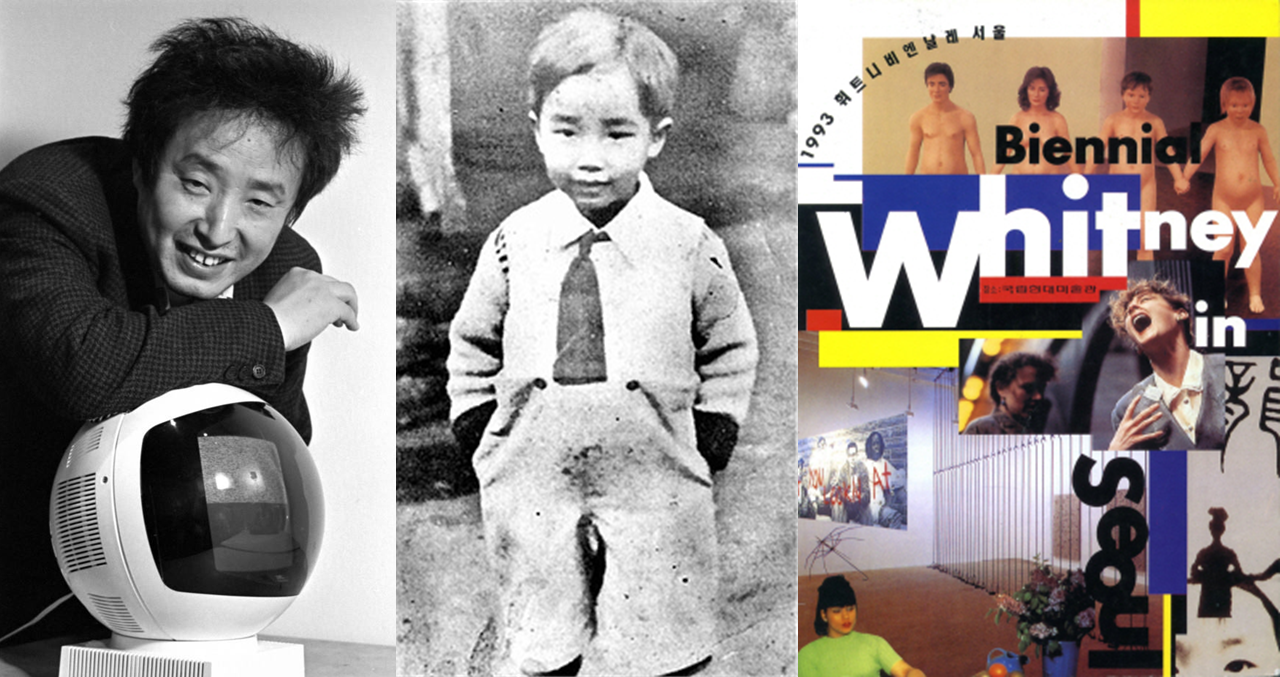

Photo by Zach Key on UnsplashThis is reflected in the Korean art market as well, and online “Art-tech” is especially grabbing a lot of attention. “Art-tech,” a combination of the word “art” and “investment techniques,” is a term coined in South Korea to describe various methods of investing in artworks.

There has been an inflow into the market of the younger generation, who are more comfortable and familiar with online experiences, stimulating various online art investment platforms to grow.

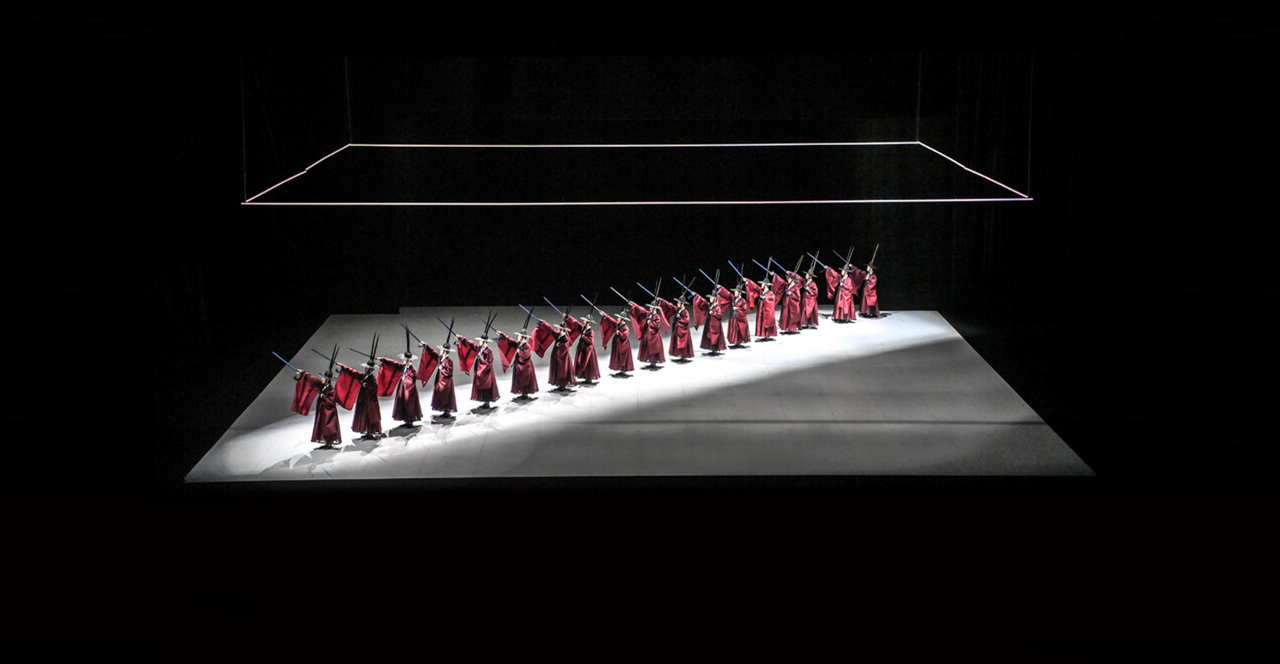

Art Busan 2021. Courtesy of Art Busan.

Art Busan 2021. Courtesy of Art Busan.One of the new types of art investments emerging in the Korean art market is fractional investment in art or sharing ownership of an artwork. A piece of art could cost hundreds of millions of dollars, but this method allows collectors to own part of such a work as investing in stocks.

The minimum investment amount varies platform by platform, from 1,000 KRW (roughly around $1) to 100,000 KRW ($100), which enables young investors in their 20s and 30s to own a share in works by famed modern and contemporary artists such as David Hockney, Banksy, Andy Warhol, Kim Whanki, and Lee Ufan with a small amount of money.

Photo by Myriam Jessier on Unsplash

Photo by Myriam Jessier on UnsplashAccording to the Korean Art Market Information System(K-ARTMARKET), the number of art transactions for fractional ownership made by five art investment companies was 5.39 billion KRW ($4.6 million) in 2019 but reached 6.67 billion KRW ($5.6 million) in 2020, an increase by 23.7% in a year. As of May this year, the transaction nearly recorded 5 billion KRW ($4.2 million).

Industry players understand there are several reasons for this sudden increase in such platforms: the younger generation’s interest in artworks has risen as the market has quickly shifted online due to COVID-19, and celebrities’ affection for art has been talked about, such as the late Samsung chairman Lee Kun-hee’s national donation and one of the K-pop group BTS members RM’s donation to a national art museum.

Photo by Lorenzo Herrera on Unsplash

Photo by Lorenzo Herrera on UnsplashAbove all, however, these new buyers are looking for a relatively stable investment option because the local financial market is full of uncertainties as low-interest rate continues to cause housing prices to surge and debts to soar.

Compared to the local housing and equity markets, the art market has been booming throughout the year, and as artworks are not subject to market fluctuations, many people view them as stable investments.

Art Busan 2021. Courtesy of Art Busan.

Art Busan 2021. Courtesy of Art Busan.Some market watchers anticipate the market will simmer down as this fast-growing interest among the majority of young art collectors is merely a buy-to-leave. But at the same time, many others project that this rising popularity of art investment may lead novice collectors to develop an eye for contemporary art and become a new foundation in the local art market.

Although fractional art ownership has many advantages and is rapidly emerging as an attractive investment method, it is a new industry. And since most of the platforms are registered as online marketing businesses, they lack the regulation that could protect investors from legal and financial risks.