The Current Art Market Status as Seen Through Korean and International Art Auctions

The South Korean art market has been on the decline, with factors such as rising global interest rates affecting both art sales and auction results. This has shifted demand towards reasonably priced modern artworks with established value rather than contemporary artists.

While art fairs don’t provide precise revenue results, the overall performance of art fairs around the world this year, including Frieze Seoul, appears to have fallen short of last year. The results of public auction sales are facing similar challenges, both domestically and internationally.

One contributing factor is rising global interest rates. According to the New York Times, as interest rates rise, people are favoring assets like bonds and savings over investments like art due to the costs and insurance issues associated with the latter.

Consequently, Sotheby’s auction on October 5, the largest ever held in Asia, was less successful than expected. The auction featured the collection of Liu Yiqian and his wife Wang Wei, China’s most prominent art investors. While the auction took place in Hong Kong, it was streamed online worldwide, generating a total of $69.5 million including commissions. However, Sotheby’s had initially anticipated sales of $95 million to $135 million.

Among the auctioned items was Amedeo Modigliani’s portrait Paulette Jourdain, which, despite commanding the highest price for modern Western art sold in Asia, was auctioned at $34.9 million, falling short of the estimated price of over $45 million.

While the art market has long been considered a relatively stable investment for collectors, artworks that have not been fully vetted by the art world are vulnerable to market fluctuations. This has not, however, meant that old masters are in demand. Recently, demand has gravitated more toward artworks by reasonably priced blue-chip contemporary artists. For instance, during Sotheby’s Hong Kong auction, bidders showed a tendency to acquire works by younger artists at the lowest prices.

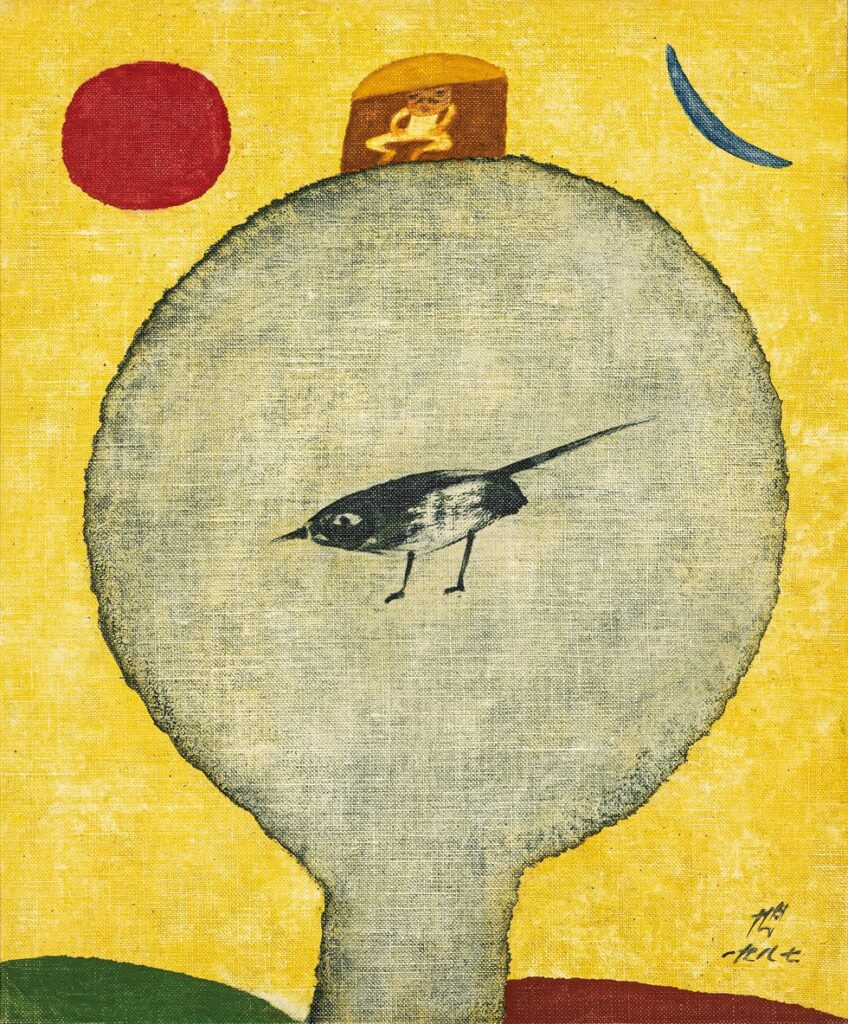

On the other hand, the trend in the Korean auction market, which began to decline in the second half of 2022, is slightly different. It favors modern artworks with clearly proven value rather than works by younger artists who are currently active.

According to Korea Art Authentication Appraisal Inc. (KAAAI), the domestic art auction market generated about 81.1 billion won in sales in the first half of this year, 56% of the same period last year. According to the KAAAI’s “Art Market Analysis Report for the First Half of 2023,” the total amount of winning bids at the country’s two largest auction houses, Seoul Auction and K Auction, in the first half of this year was 25.05 billion KRW and 2,471 billion KRW respectively, a sharp drop of 64.1% and 39.0% from the first half of last year. Similarly, the winning rate was 68.1% for Seoul Auction and 71.2% for K Auction, down 12.8% and 9.8% respectively.

The demand for younger artists has also changed. Works by young artists Woo Kukwon, Moon Hyung-tae, and Kim Sunwoo, whose prices had increased rapidly in previous years, saw a noticeable decline in 2022, although they still had a 100% winning rate. Woo’s works saw a 57.8% year-on-year decrease in total bids in 2022, and Moon’s works saw a 66.7% decrease.

Meanwhile, the trading of modern art pieces from the late 19th to the 20th century has become more active. For example, at Seoul Auction in June, the overall success rate for art auctions was only 67%, but the modern art category saw 12 out of 15 pieces sold, resulting in an 80% success rate. Modern art pieces, which have been less prominent than classical and contemporary art, have begun to attract attention mainly because their values are verified in comparison to the recent works by living artists, and they are relatively affordable, with many smaller pieces being available.

Sotheby’s, despite the contraction of the art market, opened its Korean office in Hannam-dong on September 19. Although Sotheby’s had previously entered Korea in the 1990s, it withdrew in the early 2000s.

Nathan Drahi, Managing Director of Sotheby’s Asia, told The Korea Times that the company’s return in spite of signs of a downward spiral in the Korean art market is “largely due to the dynamism of the Korean art market and the art revival.” He added that “the Korean auction market is expected to more than triple in size in 2022 from $300 million in 2019, and there’s a lot of art buying going on.”

The Korean art market was so small that it wasn’t even counted until 2021, but now it has grown fast enough to rank seventh globally, tied with Spain and Japan. Despite this growth, South Korea’s downturn has been deeper than the global markets. The South Korean auction market’s value fell by 44% in the first half of this year. However, it still remains higher than in 2019.

Hope remains on the horizon, however. Christie’s, one of the world’s two major auction companies alongside Sotheby’s, has been operating its Korean office since 2000. Francis Belin, the general manager of Christie’s in the Asia-Pacific region, noted that the number of millennial art buyers in Korea doubled in the first half of this year. He believes that Korea is a resilient market, and there is still a steady demand, despite the art market’s downturn.

Aproject Company. Co., Ltd | Founder & CEO : Jay Jongho Kim

216 Dosan-Daero, B2F, Gangnam-gu, 06047 Seoul, Korea

Business Number : 894-88-01945

Contact : aproject.company@gmail.com

Mail-order-sales registration number : 제 2021-서울강남-04243 호