Title image of the “2022 Korean Art Market Settlement Seminar” organized by the Korea Arts Management Service (KAMS). © KAMS.

Title image of the “2022 Korean Art Market Settlement Seminar” organized by the Korea Arts Management Service (KAMS). © KAMS.On November 30, 2022, the Korea Arts Management Service (KAMS) held the “2022 Korean Art Market Settlement Seminar – Changes in the Art Market II” to discuss the size of the 2022 Korean art market and its future prospects, an analysis of its art market consumers, and the future changes of Kiaf SEOUL after the joint fair with Frieze Seoul this year.

Instead of covering all the contents of the seminar, this article focuses on the scale of the Korean art market in 2022 and the discussion regarding the future direction of the Kiaf SEOUL and Frieze Seoul.

Hauser & Wirth, Frieze Seoul 2022. Photo by Let's Studio. Courtesy Frieze and Let's Studio.

Hauser & Wirth, Frieze Seoul 2022. Photo by Let's Studio. Courtesy Frieze and Let's Studio.Cho Sohyun, head of the Visual Arts Information Support Team at KAMS, summarized the total sales figures for art auctions and art fairs in 2022 as of November 15, 2022.

In 2022, the total amount of sales at the Korean art auction market was 242 billion KRW, a decrease of 28.5% from the previous year’s 324 billion KRW. The size of the Korean art auction market peaked in the third quarter of 2021 and has since gradually declined; however, the market size is still more than double what it was in 2020. Market watchers say that the bubble in the Korean art market is breaking and has entered a correction phase.

South Korea has about ten art and antique auction houses, but Seoul Auction and K Auction accounted for 85.8% of the total art auction market in 2022. Seoul Auction raised about 102.4 billion KRW in sales, accounting for about 50% of the total market, and K Auction accounted for 35.8% of the total market with 72 billion KRW.

The total sales amount of the two auction houses showed a decline compared to 2021; as of November 15, the two companies’ sales amount together totaled 174.4 billion KRW, a decrease of 29.8% from the previous year’s 248.5 billion KRW.

Despite the auction market’s downtrend, it was observed that the share of various artists other than mega artists is also growing in the Korean art auction market. The share of sold works at auction houses by the top 10 blue-chip artists, such as Kim Whanki, Yayoi Kusama, and Lee Ufan, increased gradually from 49.3% in 2018 to 73.3% in 2021. As of November 15, 2022, the share of the top 10 artists had decreased to 56.4%, indicating that the demand for works by artists other than blue-chip international artists and Dansaekhwa artists has grown compared to the previous years.

Taro Nasu, Frieze Seoul 2022. Photo by Lets Studio. Courtesy Lets Studio and Frieze.

Taro Nasu, Frieze Seoul 2022. Photo by Lets Studio. Courtesy Lets Studio and Frieze.In the case of art fair sales, KAMS collected the sales performance of each fair through press releases. According to the results of the art fair market sales in 2022, the art fair market continued to grow in the first half of 2022 but began to decline in the second half of the year. The art fairs held in the first half of 2022, including the Galleries Art Fair, the Busan Annual Market of Art (BAMA), Art Busan, and Plastic Art Seoul (PLAS), experienced sales that were more than double those of the previous year. However, the art fairs held in the second half of this year, including Kiaf SEOUL and Daegu International Art Fair (DIAF), saw a decrease in total sales or only a slight increase.

Yet, the size of the overall Korean art fair market has grown significantly. In 2021, the Korean art fair market accounted for a total of 189 billion KRW in sales. In 2022, it reached approximately 302 billion KRW, an increase of 59.9% from the previous year. This number does not include the sales from the first Frieze Seoul.

Kiaf SEOUL 2019. Photo by Kiaf SEOUL operating committee. Courtesy of Kiaf SEOUL.

Kiaf SEOUL 2019. Photo by Kiaf SEOUL operating committee. Courtesy of Kiaf SEOUL.As the Korean art market enters a transitional period, the outlook for the market’s future is both positive and negative. The size of the art auction market has decreased significantly, and the art fair market is also showing a decline. And due to the impending economic recession and rising interest rates, some experts say that the Korean art market will experience a downturn in the near future.

Nevertheless, the fair in September, held jointly by Frieze Seoul and Kiaf SEOUL, provided a greater foundation for international collectors and art experts in the Korean contemporary art world. As the pandemic becomes less severe, restrictions on international travel are being lifted, which is anticipated to attract a greater number of international artists to the country in the coming year.

Kiaf SEOUL 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.

Kiaf SEOUL 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.Regardless of these outlooks, the Korean art market has undergone significant changes since Frieze Seoul, and many more changes are expected in the future.

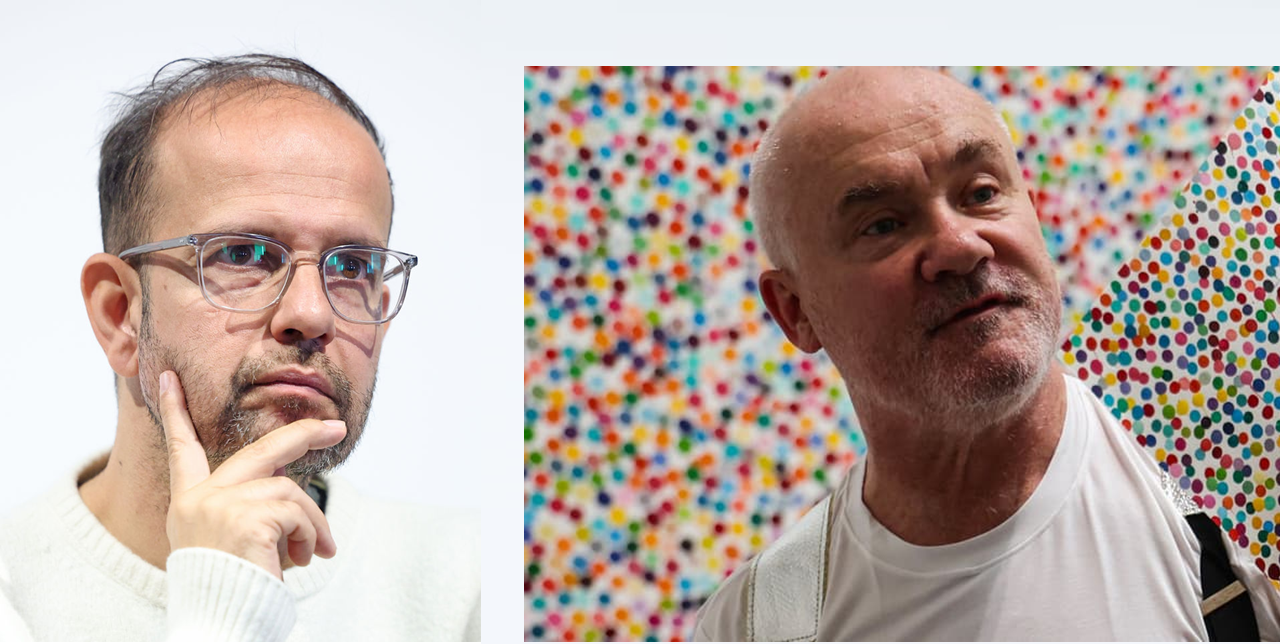

To discuss the future direction of the Korean art market, especially after Frieze Seoul and Kiaf SEOUL held their fairs together, KAMS held a Roundtable with Emma Son, senior director of Lehmann Maupin, Lee Jang-wook, chief curator of Space K, an art museum, Lee Han-bit, reporter of the Herald Economy, and Park Wonjae, director of One and J. Gallery, a Korean gallery.

After Frieze held its first fair in Seoul, the Korean art world has been debating the future of Kiaf SEOUL. The panels all agreed that it is important for the local fair to accept its place in the global art world and develop a strategy that will appeal to the international art market. Reporter Lee Han-bit especially emphasized that the scale and reputation of Kiaf SEOUL are evidently different from those of Frieze, so the local fair should adopt a strategy that is unique to the Korean art market rather than attempting to exceed its capacity.

In relation to this, One and J. Gallery’s Park Wonjae shared his experience at Frieze Seoul this year. To present something different from other booths and other international art fairs, One and J. Gallery set up their booth to introduce the works of a young Korean artist, Jong Oh and Ham Jin. Oh’s works examine the relationship between the exhibition space and viewers using the fewest materials and gestures possible. And Ham is an artist who achieved great amount of attention in the Korean art world for his microscopic clay figures tinged with fantasy. Park considered Oh and Ham’s works to be very distinct from the other artworks at the fair that could only be found in Seoul.

Chief Curator Lee Jang-wook described his visit to London during Frieze week, focusing on the Sunday Art Fair, which is no longer held due to the changed economic situation in the country. It was a small fair of around thirty booths that featured new and emerging artists and galleries from around the world. Lee often visited the fair to keep up with the most recent contemporary art trends, learn about new, promising artists, and work with some of them at the museum. Lee emphasized the significance of continuously running a fair that showcases talented artists with great potential and introduces the next trend in contemporary art in Korea.

Kiaf SEOUL 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.

Kiaf SEOUL 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.Senior Director of Lehmann Maupin’s Emma Son explained that the international art world’s interest in the Korean art world had already been steadily growing prior to the announcement that Frieze would open a Seoul edition. Since 2017, mega-galleries such as Lehmann Maupin and Pace have been opening branches in Seoul. Son also added that international collectors had frequently been inquiring about Korean art at the gallery.

According to Son, numerous international art experts visited art museums, galleries, and artist studios during the Frieze Seoul period to experience Korean culture and contemporary Korean art. These visitors were particularly interested in young and emerging Korean artists as well as modern masters associated with Korean avant-garde art, which will be introduced at the Guggenheim Museum in 2023.

In addition, the Roundtable predicted how Kiaf and Frieze will evolve in the coming year. Reporter Lee Han-bit predicted that Kiaf and the local art world will host a greater variety of VIP events. Many galleries and art organizations in Korea have learned from the joint fair with Frieze that these VIP events are essential for establishing connections between the Korean and international art worlds.

Frieze Seoul, on the other hand, will feature overseas galleries with a greater knowledge of Korean collectors. Galleries that participated in the Korean art fair for the first time but lacked familiarity with Korean art collectors had to ship back the majority of the artworks at their booths, despite featuring popular artists.